The agent economy has arrived faster than anyone expected.

Companies that spent years perfecting their SaaS businesses suddenly find themselves deploying AI agents: autonomous systems working 24/7, handling tasks that used to require people. Sales agents now book meetings, support agents resolve tickets, and operations agents process workflows.

There’s just one problem: we're trying to monetize these agents using infrastructure built for a completely different business model.

The SaaS inheritance problem

Most companies transitioning to agents today inherited their billing approach from traditional SaaS: an approach that ran two systems in parallel. One system tracks what agents do: tasks completed, minutes run, tokens consumed. Another system sends invoices, built on solutions like Stripe or Chargebee.

This worked fine when you charged per seat. Your billing system counted active users and multiplied by $99. You didn't need to know what those users actually did because usage didn't affect pricing. A seat was a seat.

Agents don't work that way. They run continuously, doing different work for different customers with volumes that vary wildly. Now your legacy tracking system knows what happened: Agent A processed 2,847 support tickets, Agent B booked 47 sales meetings, and Agent C handled 1,203 customer queries. Your legacy billing system knows what you charged: Customer X paid $5,000. Customer Y paid $12,000.

Problem is, now nobody knows whether those numbers match up. Whether you charged the right amount to the right customer, and whether you're even making money. As a SaaS company transitioning into AI, what you really need are tracking and billing systems that talk to each other and share the same data.

Better yet: a unified system that builds both on top of a single source of truth.

Data silos stack up fast

Jonathan Sanders, CEO and founder of Light, saw this SaaS inheritance problem everywhere during his years at Cleo and Juni. Finance systems that don't talk to operational systems. Data trapped in silos. All culminating in teams fighting over whose numbers are correct.

When we spoke with him on the Get Paid podcast, Jonathan described the real costs: "The downside to this siloed system is that you can't experiment, you can't prove value to customers, and you can't actually know if you're making money. Everything becomes manual reconciliation and guesswork."

The practical implications of these data silos stack up fast.

Your tracking system knows an agent resolved thousands of support tickets. But what's that worth? How many hours of human work did that represent? What would it have cost to do manually? Your billing system has no way to calculate this, so you're either guessing at pricing or defaulting to cost-plus models that miss the value you're creating.

The two-system approach also hampers your ability to experiment. Want to switch from per-minute billing to outcome-based pricing? You need to rebuild both systems and manually map data between them. That project takes months. By the time you've solved this problem at human-speed, the market has moved at agent-speed.

The stakes are existential. Agents work invisibly. Which means customers can't see what's happening, so they don't feel the value. In our experience 80% of agent companies today hit a renewal cliff between months 6 and 9. Without proof, you're asking customers to renew on faith. And faith doesn't survive budget reviews.

Meanwhile, as agents get more versatile, numerous, and performant, legacy systems break under the weight of reconciliation. Every month, someone pulls usage data from one system, billing data from another, and tries to reconcile them manually in Excel.

Pricing on value, not costs

When we started building Paid, we asked ourselves: what does agent billing actually need to do?

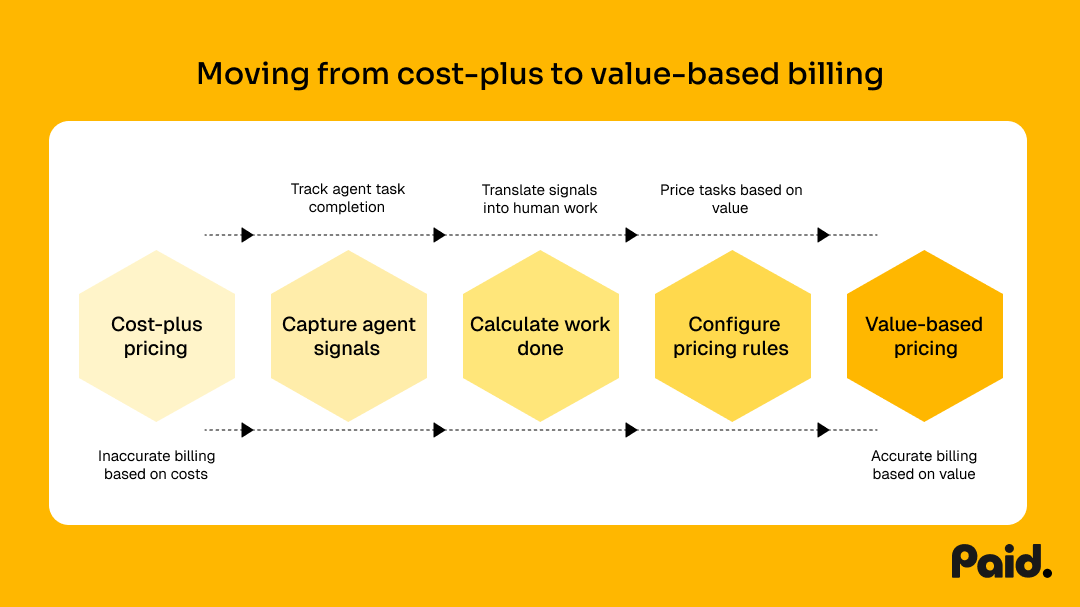

The answer became clear once we stopped thinking about compute costs and started thinking about value.

No doubt compute costs matter. The fastest-growing agent companies average just 25% margins compared to 80% for SaaS, with some top performers running negative. That's almost always a good thing.

But you can't price on costs alone when a single agent operation might cost $0.10 or $10 depending on complexity. Cost-plus pricing breaks when costs can vary 100x or more.

What you can price on is value delivered. One easy way to do this is to measure value in labor terms: Human Equivalent Value (HEV).

A support agent that resolves 2,847 tickets in a month costs you $340 to run. But it delivers 712 hours of human work. At a typical support analyst rate of $45 per hour, that's $32,040 in value. You need to know both numbers: what it cost you and what it's worth to the customer.

Calculating HEV means understanding what agents actually do, then billing for that value. And ideally you need one system that captures agent signals, translates them into human equivalent work, and prices them based on value delivered.

That's how we built Paid. We capture every action your agent takes and calculate the human equivalent work: this would have taken 15 minutes of analyst time, or this replaced 2 hours of sales rep work. And we enable you to price the task accordingly.

With our platform, customers configure pricing rules based on value, not cost. Charge $50 per meeting booked because a meeting booked is worth far more than the $0.30 it cost in compute. Charge $15 per support ticket resolved because you're saving the customer an hour of manual work.

The unified Paid system tracks the signals, calculates human equivalent value, applies your pricing rules, and generates invoices. One data set. One source of truth.

Aligning around value

When tracking and billing are unified around human equivalent value, everything changes.

You can see what agents cost to run versus what value they delivered. When you can see both numbers, you can find the pricing that captures value while protecting margins.

The transparency that emerges from this completely shifts customer conversations. Instead of defending costs, you're now demonstrating value: "Your agents booked 47 sales meetings this month. That's 94 hours of SDR work, equivalent to $8,460 in fully loaded labor cost. We charged you $2,350."

In fact, you don't need to limit your thinking to human work. While it might have cost $8,640 to have reps book those 47 meetings, the value of those meetings will be much higher. Let's say every meeting booked drives $10k in sales. Now your agent has created $470,000 in value. That $2,350 you charged them suddenly looks pretty low.

Pricing experiments that used to take months now happen in hours. Want to change how you define outcomes by use case or customer? Change the rule. Want to tier pricing by complexity? Add the calculation. Want to offer volume discounts on high-value work? Just input the numbers and generate an invoice. With a unified agent growth platform, all of this is possible without rebuilding your systems.

And the manual reconciliation work just disappears. Usage, value, and revenue live in one place. Reports generate automatically.

This is the sustainable and scalable infrastructure that makes durable agent economics possible.

Focus on growth, not just billing

If you’re growing your AI offering right now, look at your billing infrastructure. Can you measure human equivalent value for the work your agents do?

Instead of asking "how many tokens did this consume?" or "how many minutes did this run?" you should be asking "how much human work did this replace, and what would that work have cost?"

If you can't answer that question with data, you're working with a fundamental handicap.

Traditional billing platforms weren't built for this. Stripe and Chargebee are excellent at processing payments based on fixed contracts and seat counts. But they can't understand agent signals, the discrete work events that need to be translated into value and priced accordingly.

That's why companies using these platforms for agent billing end up building custom tracking systems. And even then, they're usually just tracking usage metrics, not calculating the value of work delivered.

You need a unified system that captures agent signals, calculates value, and bills your customers based on value delivered. You need one source of truth for what agents do, what that work is worth, and what you charge.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

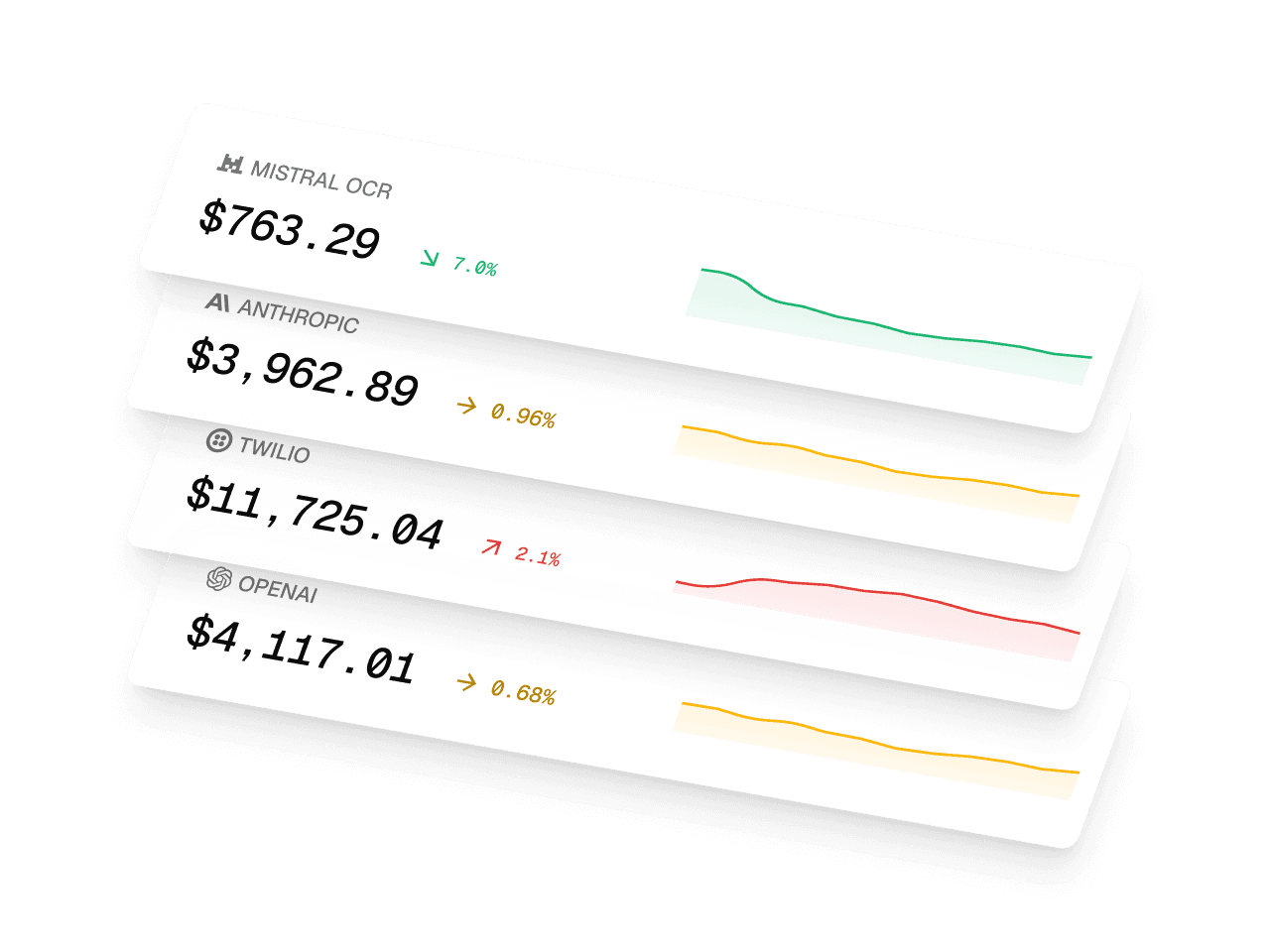

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes