As SaaS companies race to introduce AI agents, most are adopting a hybrid pricing model - seat-based fees plus credit bundles for AI features.

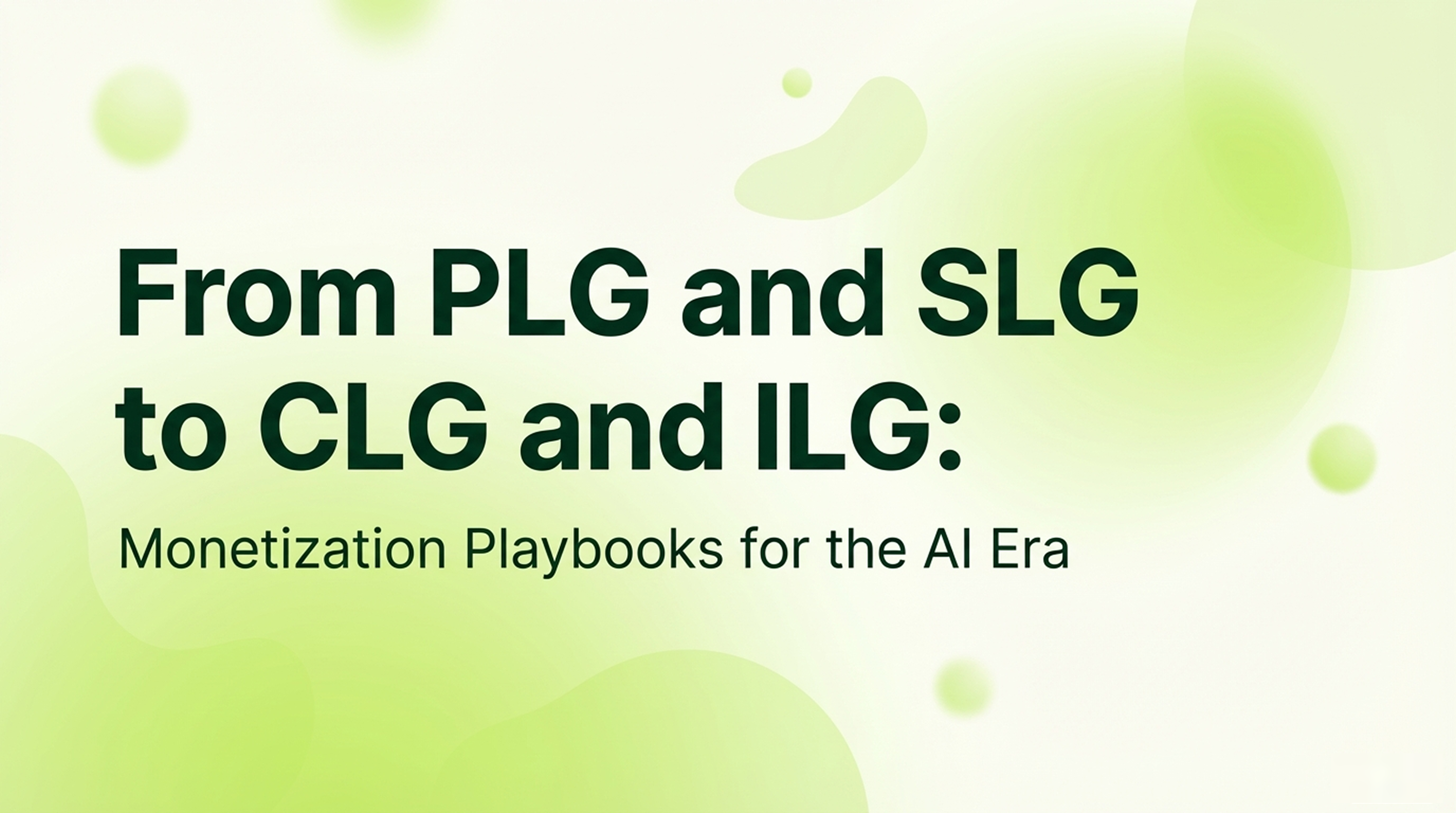

I recently spoke to a company that's seeing upwards of 80% margins on this model and that to me is a major red flag.

Why? Because 80% margins tell me that your AI agents aren’t doing much of anything.

Most companies actually winning with AI are seeing margins in the 40-60% range. According to Bessemer's State of AI 2025 report, it's more like 25% for the fastest growing AI companies, with many actually seeing negative gross margins.

80% margins reveal low agentic use

The seat + credit pricing model has become the default for AI features in SaaS, and for good reason. It's familiar to customers, easy to understand, and provides a clear path to land and expand.

But an 80% margin on credits means your users aren’t getting value from your AI features. It means:

- Customers aren't consuming enough AI to impact your costs meaningfully

- Your AI features aren't central enough to user workflows to drive real usage

- You're charging premium prices for functionality that isn't delivering proportional value

The 40-60% sweet spot

So why do margins compress to 40-60% specifically when AI is working?

This range represents the equilibrium point where AI is delivering genuine value to users, but you're investing enough to do it right. You've moved beyond trivial automation into meaningful product transformation.

Here's what companies in this margin range typically look like:

- High credit consumption. Users aren't just trying the AI feature occasionally, they're burning through credits because the AI functionality has become essential to their workflow. This drives up your compute costs significantly.

- Deep product integration. The AI isn't a separate feature users navigate to; it's woven throughout the core product experience. This requires substantial engineering investment to build the connective tissue between your existing product and AI capabilities.

- Proactive agent behavior. Instead of users manually triggering AI tasks, agents are working in the background, analyzing data, generating insights, and automating workflows without explicit prompts. This "always-on" approach drives usage (and costs) much higher.

- Sophisticated context management. Your agents have access to user-specific data, historical context, and relevant knowledge bases. Building and maintaining these retrieval systems represents a decent chunk of your AI infrastructure costs.

Companies operating at these margins are able to outgrow competitors by serving more use cases, delivering faster results and handling complexity that would be impossible with manual workflows or simple AI features.

What your margins are telling you

This doesn't mean you should artificially inflate your costs or give away AI for free. The point isn't that lower margins are inherently better. The point is that meaningful AI adoption requires investment, and that investment naturally compresses margins in the short to medium term.

If you're sitting at 80% margins on your AI offering, here are the questions you need to ask:

- What's your credit consumption rate? If users are only burning through 30-40% of their allocated credits each month, your AI isn't integrated deeply enough into their workflows

- Could a competitor replicate your AI in two weeks? If you're just a thin wrapper around OpenAI's API with basic prompts, you don't have an AI strategy, you have an API subscription with markup.

- What percentage of your engineering team is focused on AI? If it's less than 20%, you're not building AI-native, you're building traditional software with AI sprinkled on top.

- Are you investing in proprietary AI capabilities? Custom fine-tuning, specialized evaluation datasets, unique agent orchestration, these create defensibility. Generic API calls don't.

The uncomfortable truth is that the companies playing it safe with AI, maintaining high margins and minimal investment, are setting themselves up to be disrupted by competitors willing to compress margins today to build unassailable advantages tomorrow.

Your margins will tell the story

80% margins say you're playing it safe, adding AI as a feature rather than rebuilding your product around it. 40-60% margins say you're making the hard investments that compound into defensibility.

The question every SaaS founder needs to answer right now isn't "How do we add AI to our product?" It's "Are we willing to sacrifice short-term margins to build an AI-native product that competitors can't replicate?"

The window for making this decision is shorter than you think. In two years, the AI-native companies will have pulled so far ahead that catching up will be nearly impossible.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

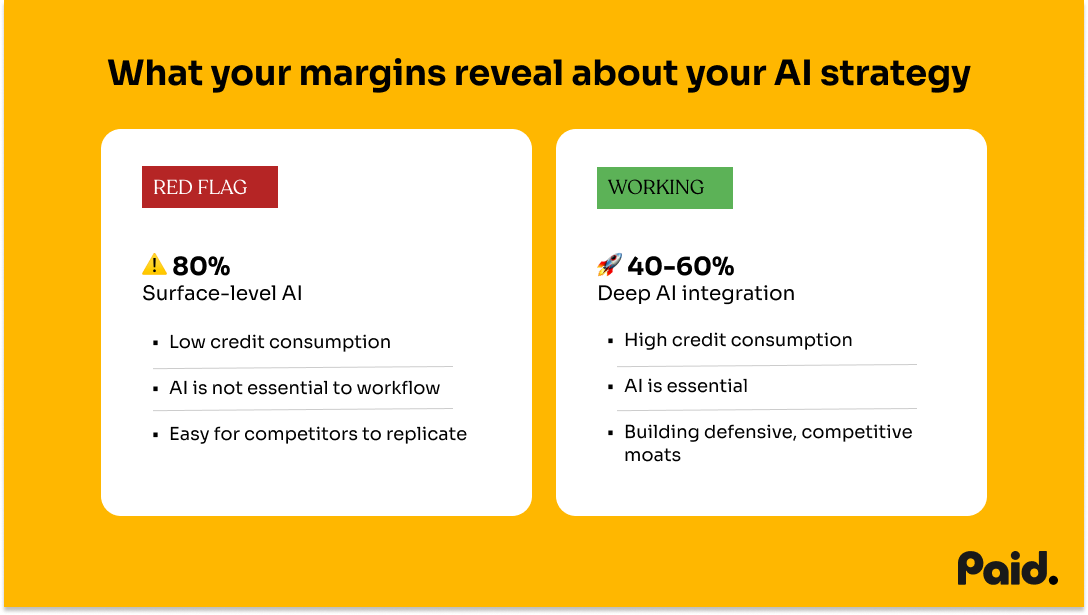

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes