We’ve been hearing from around the world - SaaS boards want an "AI strategy". Now you’re adding chatbots, adding “AI” to landing pages, and pitching "AI-powered insights."

Meanwhile, three university dropouts in a trenchcoat are building an agent that replaces your entire product. And they'll be charging $9 for what you charge $900.

Six months from now, your enterprise customers will ask why they need 47 DocuSign seats when an agent can handle every contract. Why they need ZoomInfo's $30k package when an agent can enrich leads for pennies. Why they need RingCentral at all when an AI handles every call.

You'll have a great answer about security, compliance, and enterprise features.

They won't care.

The math that will kill your SaaS

Let's use DocuSign as an example.

It’s a great product with $2.7 billion in revenue. Average enterprise contract estimated at $48,000/year, or so I’m told.

Here's what a document signing agent costs to run:

- PDF parsing: $0.20

- Signature verification: $0.001

- Workflow orchestration: $0.003

- Audit trail generation: $0.001

- Total cost per document: $0.007

A startup can charge $99/month for unlimited signatures and still have 94% margins.

Your customers aren't stupid. They can do this math too. Even if they pay for other things than just the PDF signing aspect.

Chart 1: The 90% Price Collapse Is Already Here

Your moat could sink you

"But we have enterprise features! Compliance! Integrations!"

Sure, cool story.

Let’s look at some examples:

- ZoomInfo's moat: 300 million contact profiles, painstakingly verified.

- Agent replacement: Real-time LinkedIn scraping + email verification. Cost: $0.03 per contact.

- Calendly's moat: Beautiful scheduling UI, calendar integrations.

- Agent replacement: "Find me time with John next week." Done. No UI needed.

- Zendesk’s moat: Decade of conversation data, sophisticated routing.

- Agent replacement: Agent that actually solves problems instead of routing to humans.

This moat could end up protecting you but also drowning you.

The AI-native competitor doesn't need to rebuild your features. They need to solve your customer's problem. Those aren't the same thing.

AI enhancement is a lie

Every SaaS company has the same playbook right now:

- Add ChatGPT to existing workflows

- Call it "AI-powered"

- Increase prices 20%

- Hope nobody notices it's lipstick on a pig

This isn't transformation. It's decoration.

Company type

Their "AI" feature

Agent alternative

Customer satisfaction

CRM

Suggested email templates

Fully autonomous SDR

12% vs 84%

HR software

CV keyword matching

Complete hiring agent

23% vs 91%

Analytics

AI insights

Answers any question instantly

31% vs 88%

Project management

Smart task assignment

Self-completing projects

18% vs 79%

Support desk

Suggested responses

Resolves tickets autonomously

28% vs 93%

If your AI innovation is suggested email templates, while a 5-person startup built an agent that completely replaces sales outreach, …

You get the picture.

The cannibalization dilemma

Here's your actual choice:

Option A: Protect your existing revenue model

- Keep charging per seat

- Add incremental AI features

- Maintain 70% margins

- Die slowly as customers churn to agents

Option B: Blow up your own business model

- Build agents that replace your product

- Charge 90% less

- Destroy your own margins

- Maybe survive the transition

There is no Option C. This is do or die.

The brutal truth? If you're not willing to make your own product obsolete, someone else will do it for you. And they're already building.

What Salesforce understands that you may not

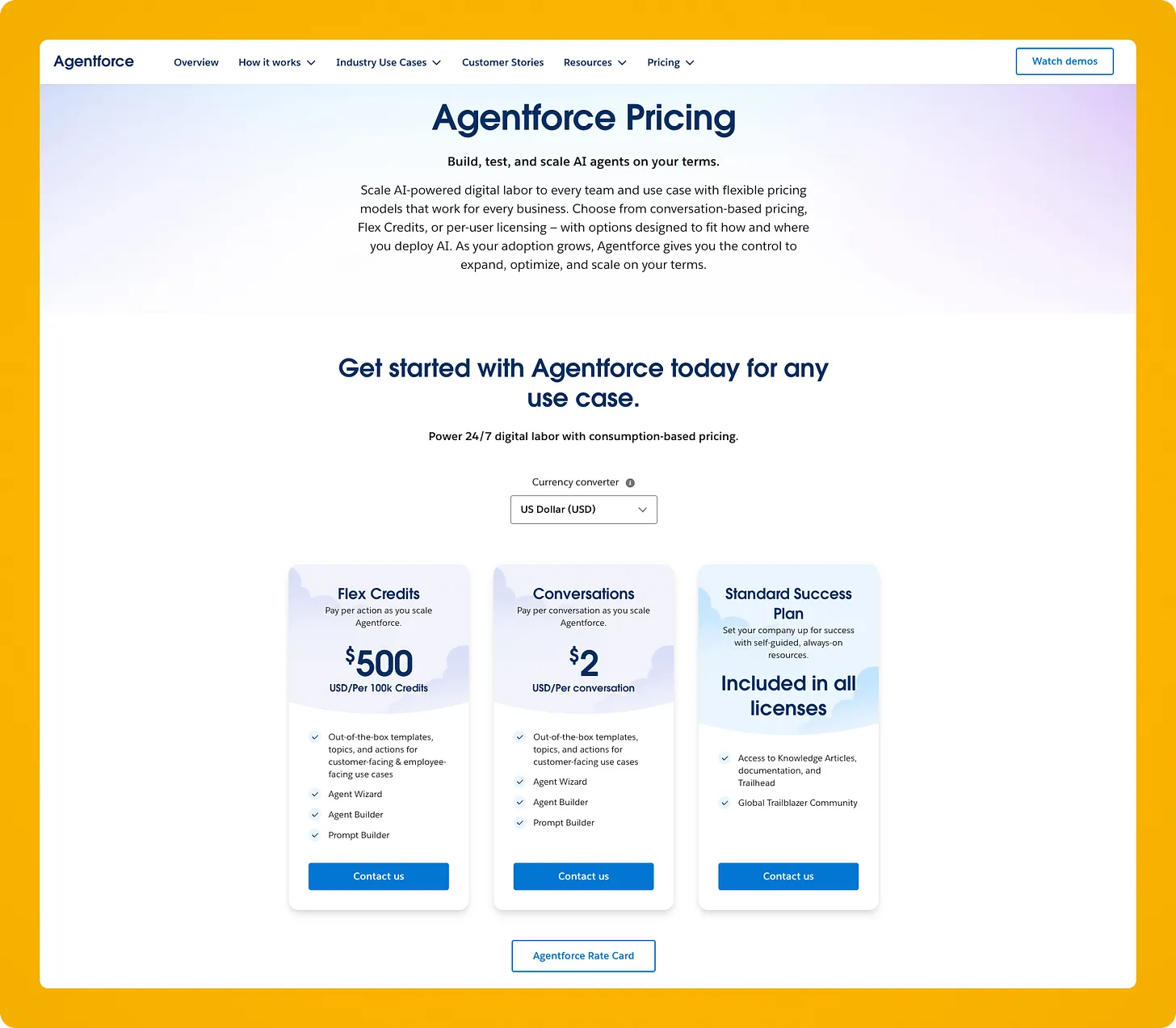

Marc Benioff launched Agentforce. Not "Salesforce with AI", not "AI-powered CRM"… Agents. That replace human work. That threaten their own seat-based model.

They're charging $2 per conversation instead of $125 per user per month. Salesforce told the market: "Our own pricing model is obsolete"

Salesforce told the market: "Our own pricing model is obsolete"

They're cannibalizing a $30 billion revenue stream. Because they know if they don't, someone else will.

Your category

Agent startups building

Funding raised

Time to feature parity

If you're Calendly

14 companies

$47M total

Already there

If you're DocuSign

8 companies

$31M total

3 months

If you're HubSpot

31 companies

$280M total

6 months

If you're Monday.com

12 companies

$67M total

9 months

If you're SalesSorce

43 companies

$520M total

12-18 months

If you're Zendesk

22 companies

$156M total

Already there

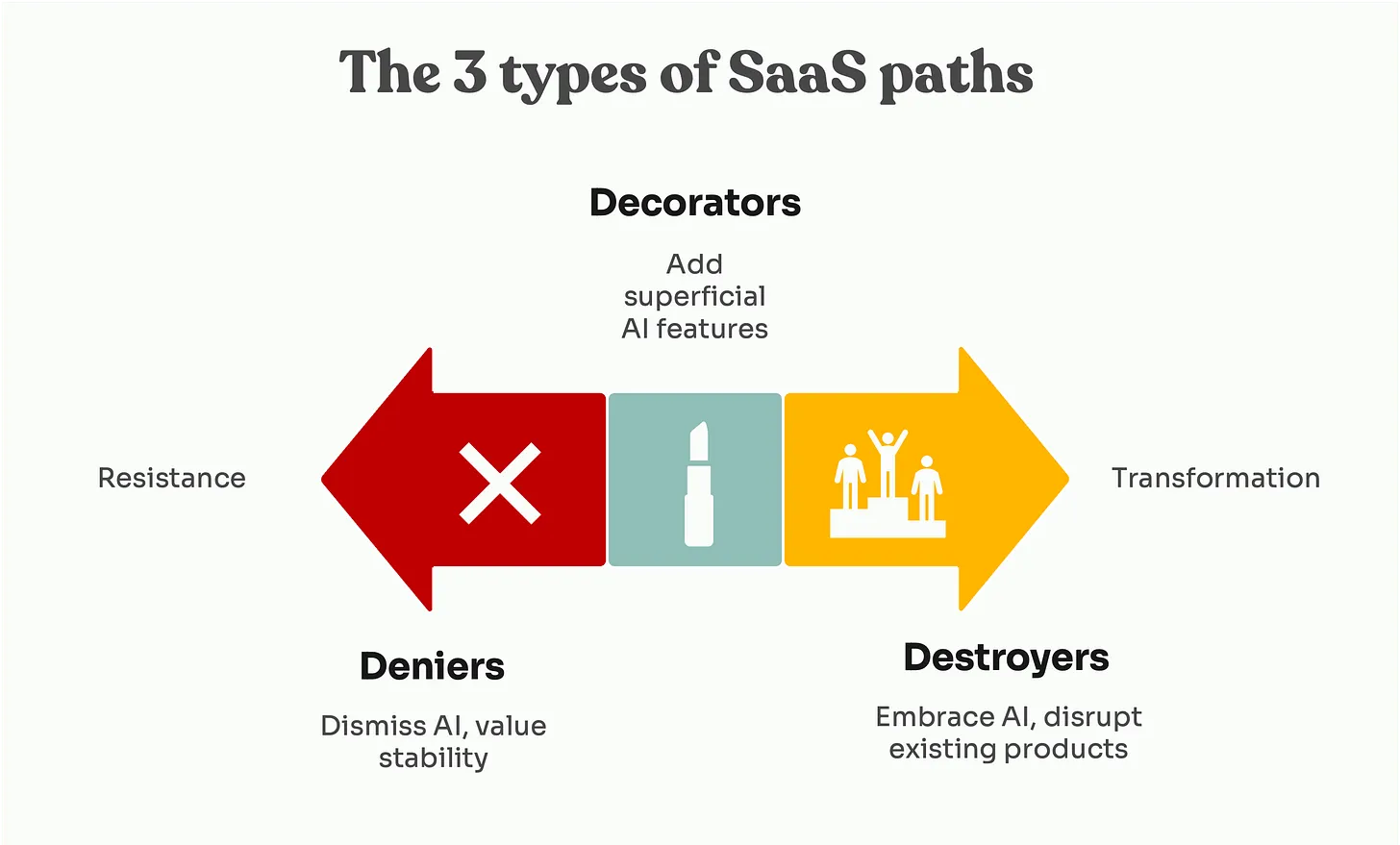

How we see the market in 3 types

I see the market split across three types: Type 1: The Deniers (45% of market)"AI is just hype. Our enterprise customers value stability."Timeline to irrelevance: 18 months

Type 1: The Deniers (45% of market)"AI is just hype. Our enterprise customers value stability."Timeline to irrelevance: 18 months

Type 2: The Decorators (40% of market)"Look, we added AI! There's a chatbot now!"Timeline to irrelevance: 24 months

Type 3: The Destroyers (15% of market)"We're building agents that make our current product worthless."Timeline to relevance: Indefinite

Where are you on this path?

If you're an incumbent SaaS - here's your escape route

Before you panic and fire your entire product team, I have some math for you.

Your board may keep asking about protecting seat revenue and ARR, but they're asking the wrong question.

- Seats in your customer's org: These are going down. Every quarter. Forever.

- Tasks they need completed: Going up. Exponentially. No ceiling.

A 50-person company used to have 40 potential Salesforce seats. Maximum.

That same company now has 50,000 potential customer interactions that need handling. 10,000 documents to process. 100,000 data points to analyze.

The constraint has flipped. You're no longer limited by headcount. You're limited by imagination.

What would work for you:

Step 1: Stop Counting Seats, Start Counting Outcomes

Salesforce didn't launch "Agentforce" as a feature, but as a shift from "per user per month" to "per conversation." That's not a pricing change!

Your version:

- DocuSign: Stop charging per user. Charge per contract value processed.

- ZoomInfo: Stop charging per seat. Charge per qualified opportunity generated.

- Intercom: Stop charging per agent. Charge per issue resolved.

The beautiful part? A 50-person company might have had 3 support agents. But they have 3,000 support tickets. You just 1000x'd your addressable market.

Think in outcomes!

Step 2: Become the orchestration layer and embed in their workflows

You can't compete with agents on cost. But you have something they don't: Trust, compliance, and a decade of edge cases.

Orchestrate the agents or AI…

For example:

- Let startups build specialized agents

- You become the governance layer

- Charge for orchestration, compliance, and quality assurance

- Take a cut of every agent transaction through your platform

Think in terms of the App Store, not apps. Think Shopify, not shops….

Step 3: Price for Abundance, Not Scarcity

The old model assumed scarcity:

- Limited seats = premium pricing

- More users = more revenue

- Growth tied to customer headcount

The new model assumes abundance:

- Unlimited tasks = volume pricing

- More automation = more revenue

- Growth tied to customer success

Here's what this looks like:

Old model

New model

Revenue multiple

10 seats x $100 = $1,000

10,000 tasks x $0.50 = $5,000

5x

50 seats x $100 = $5,000

100,000 tasks x $0.20 = $20,000

4x

200 seats x $100 = $20,000

1M tasks x $0.10 = $100,000

5x

Agents aren’t your replacement - they’re your multiplication factor

Every agent that replaces a human creates 10x more work that needs governing, monitoring, and orchestrating. Every automated workflow creates 10x more data that needs analyzing. Every AI interaction creates 10x more complexity that needs managing.

The companies that win won't be the ones that fight agents. They'll be the ones that help customers deploy 1,000 agents safely.

Get it together

Accept reality now

- Run the unit economics on outcome-based pricing

- Identify your top 10 customers' task volumes

- Model revenue at $0.10-1.00 per outcome

Pick your battlefield

- Choose: Build agents, orchestrate agents, or govern agents

- Launch a pilot with your most innovative customer

- Price it at 10x current per-seat equivalent

Burn the boats

- Announce the new model publicly

- Give customers 12 months to transition

- Show Wall Street the multiplication math

The Choice Is Still Binary

But it's not the choice you think.

You don’t get to keep seats. You need to embrace abundance, and not defend scarcity.

Seats are finite. Tasks are infinite.

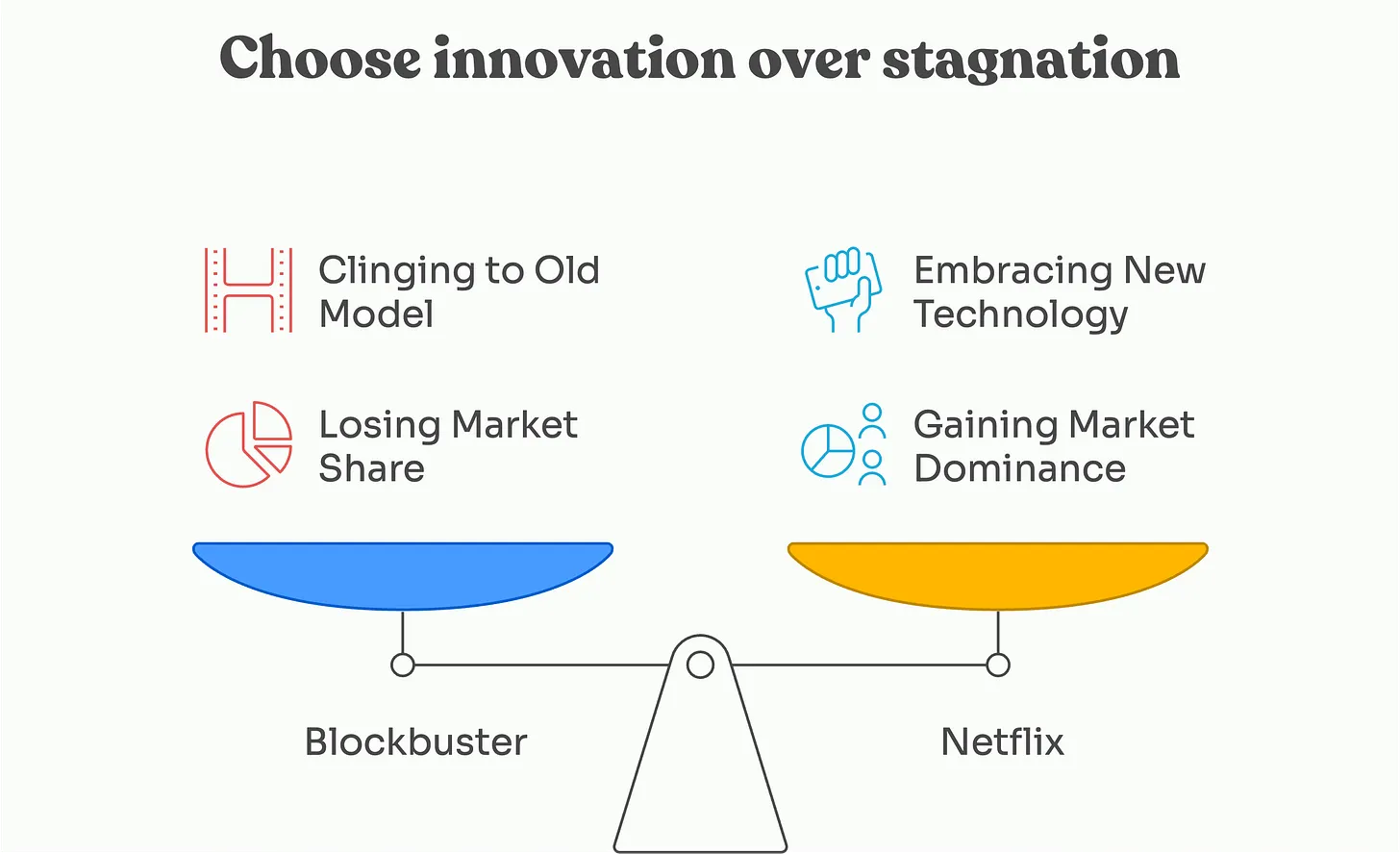

You can be Blockbuster, clutching your late fees while Netflix ships DVDs.

Or you can be Netflix, burning your DVD business to build streaming.

There's no middle ground. No hedging. No "wait and see."

Build the agent that kills your product. Or watch someone else do it.

Choose wisely.

What's your move?

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

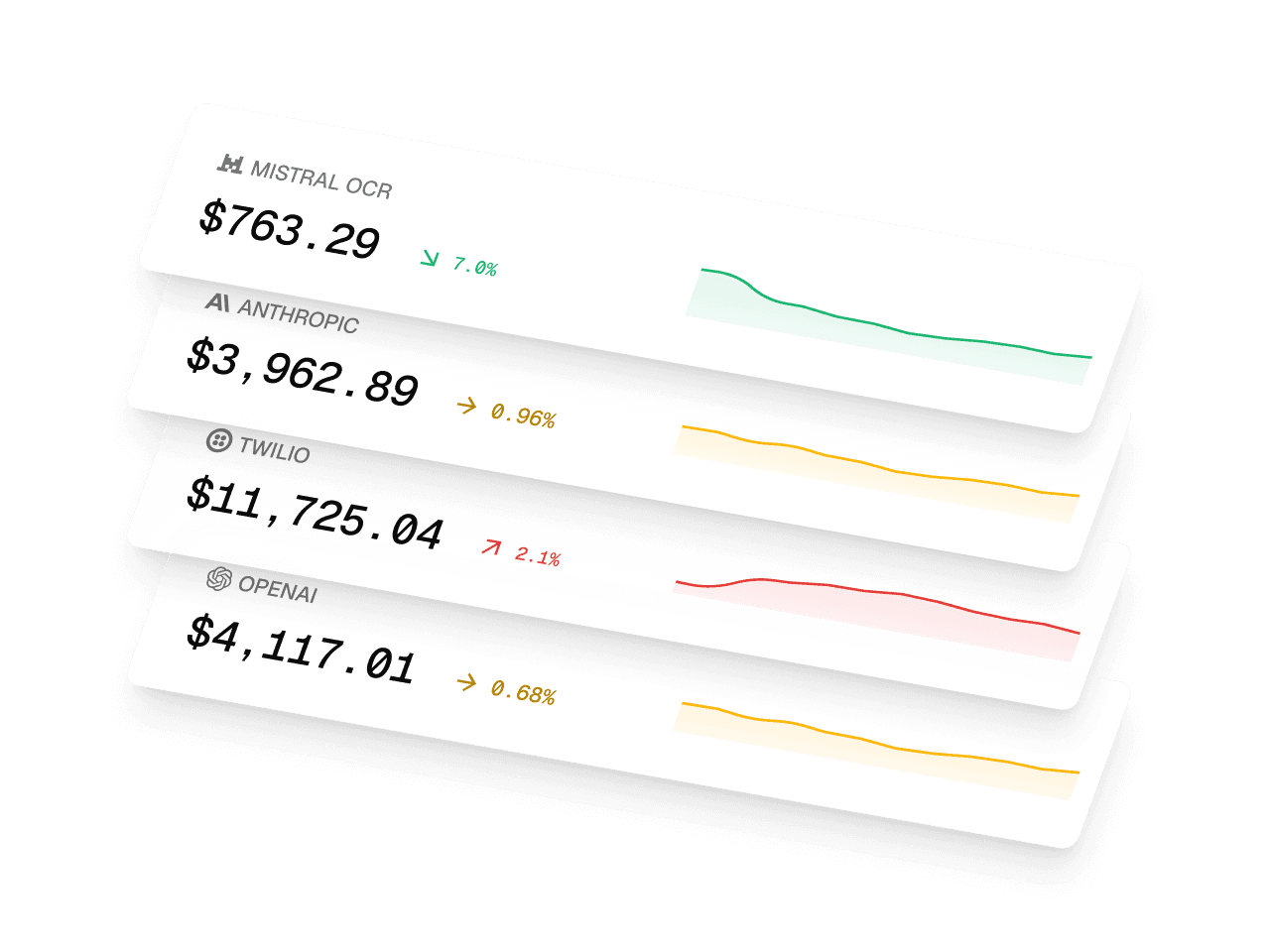

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes