I don’t need to tell you again, but the AI agent economy is exploding.

This year, tens of thousands of businesses have deployed millions of AI agents across every industry.

Most companies (over 75%!) struggle with a critical question: How do we turn these AI tools into sustainable revenue streams?

At Paid, we've pioneered the infrastructure that powers monetization for the world's most successful AI agents.

This guide shares our proven frameworks to help you design, implement, and scale your agent monetization strategy.

So what should you consider when monetizing an AI agent?

The four AI Agent pricing models dominating the market

We've identified four fundamental monetization frameworks proven by 60+ AI agent companies, each suited to different agent types and business models:

1. 👤 Agent-Based Framework: The FTE Replacement Model

2. ⚡ Action-Based Framework: The Consumption Model (also called Usage based)

3. ⚙️ Workflow-Based Framework: The Process Automation Model

4. 🎯 Outcome-Based Framework: The Results-Based Model

These frameworks are easy to compare because they are sufficiently different.

Comparison at a Glance - Usage based vs. Outcome based

Framework

Best for

Revenue model

Risk/reward

Implementation complexity

Companies using this model

Agent-based

- FTE replacement

- Enterprise deployments

- Predictable

- Recurring revenue

Low/standard

Simple

- 11x

- Harvey

- Salesforce (hybrid)

- Hubspot (hybrid)

Action-based

- Variable workloads

- BPO replacement

- Pay-per-use

- Usage-based pricing

- Consumption-based pricing

Low/standard

Simple

- Bland

- Parloa

- HappyRobot

Workflow-based

- Process automation

- Multi-step tasks

Usage based with minimums

Medium/mid-high

Moderate

- Rox

- Salesforce

- Artisan

- Icertis

Outcome-based

- Measurable results

- Performance guarantees

Success based

High/high

Complex

- Zendesk

- Intercom

- Airhelp

- Chargeflow

- Sierra

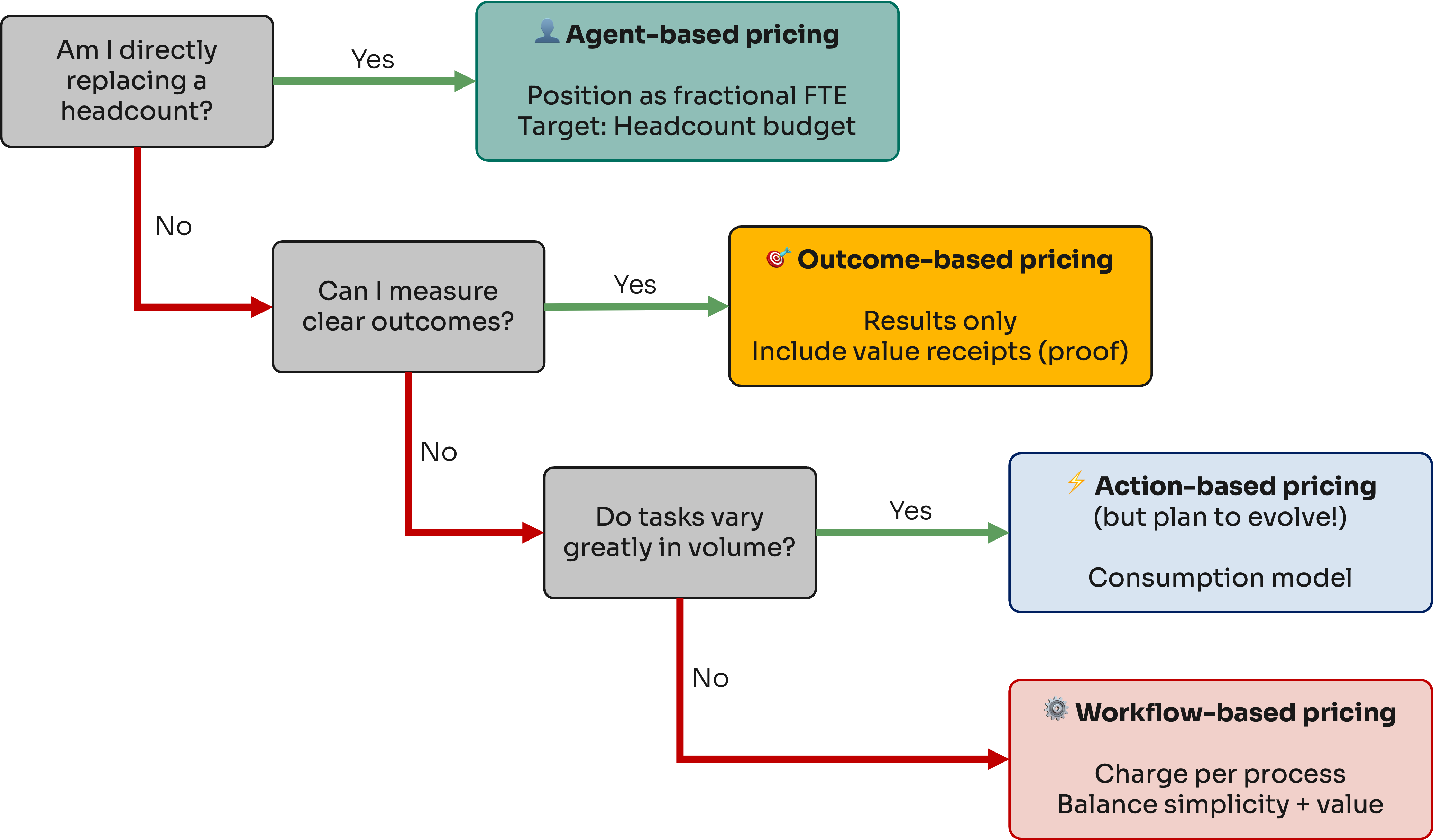

Decision framework: choose your model

Use this decision framework to select the optimal pricing model for your AI agent.

Should you be looking at usage based, agent based, or outcome based pricing?

Key questions to ask:

Key questions to ask:

- What budget am I targeting?

- Headcount budget (10x larger) → Agent-based

- BPO/outsourcing budget → Action-based

- ROI/performance budget → Outcome-based

- How commoditized is my offering?

- Unique capabilities → Any model works

- Standard features → Avoid the action-based model

- Can I prove my value?

- Clear attribution → Outcome-based

- Process efficiency → Workflow-based

- Time savings → Agent-based

Let’s look a bit deeper into each of the models, their pros and cons, and how they work:

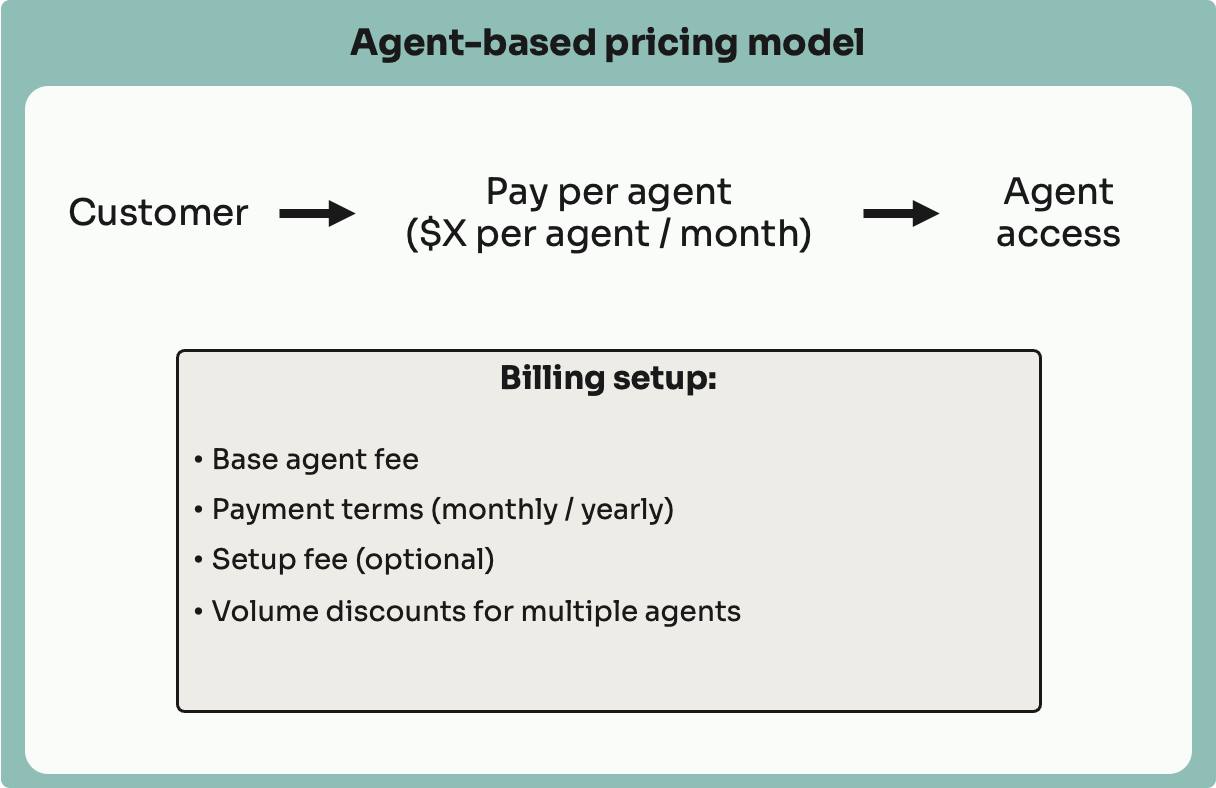

Agent-based pricing

Agent-based pricing treats AI agents like digital employees where customers pay a fixed recurring fee for each agent deployed.

This model positions agents as FTE replacements, tapping into headcount budgets rather than IT budgets.

Companies like 11x, Harvey, and Vivun have proven this approach can command premium pricing by directly competing with human hiring costs.

How It Works

Design Principles

- Position as Digital Employee: Frame your agent as a FTE replacement

- Tap Headcount Budgets: Target 10x larger budgets than traditional software

- Demonstrate Clear ROI: Show savings vs. $60,000/year junior employee

- Bundle Capabilities: Add features to justify premium pricing and resist commoditization

Implementation Guide

Step 1: Define Your Agent Tiers

- Starter: Basic functionality, single user

- Professional: Full features, team access

- Enterprise: Custom limits, SLA guarantees

Step 2: Set Pricing Anchors

- Research competitor SaaS pricing in your domain

- Price 20-30% below equivalent human cost

- Build in margin for infrastructure and support

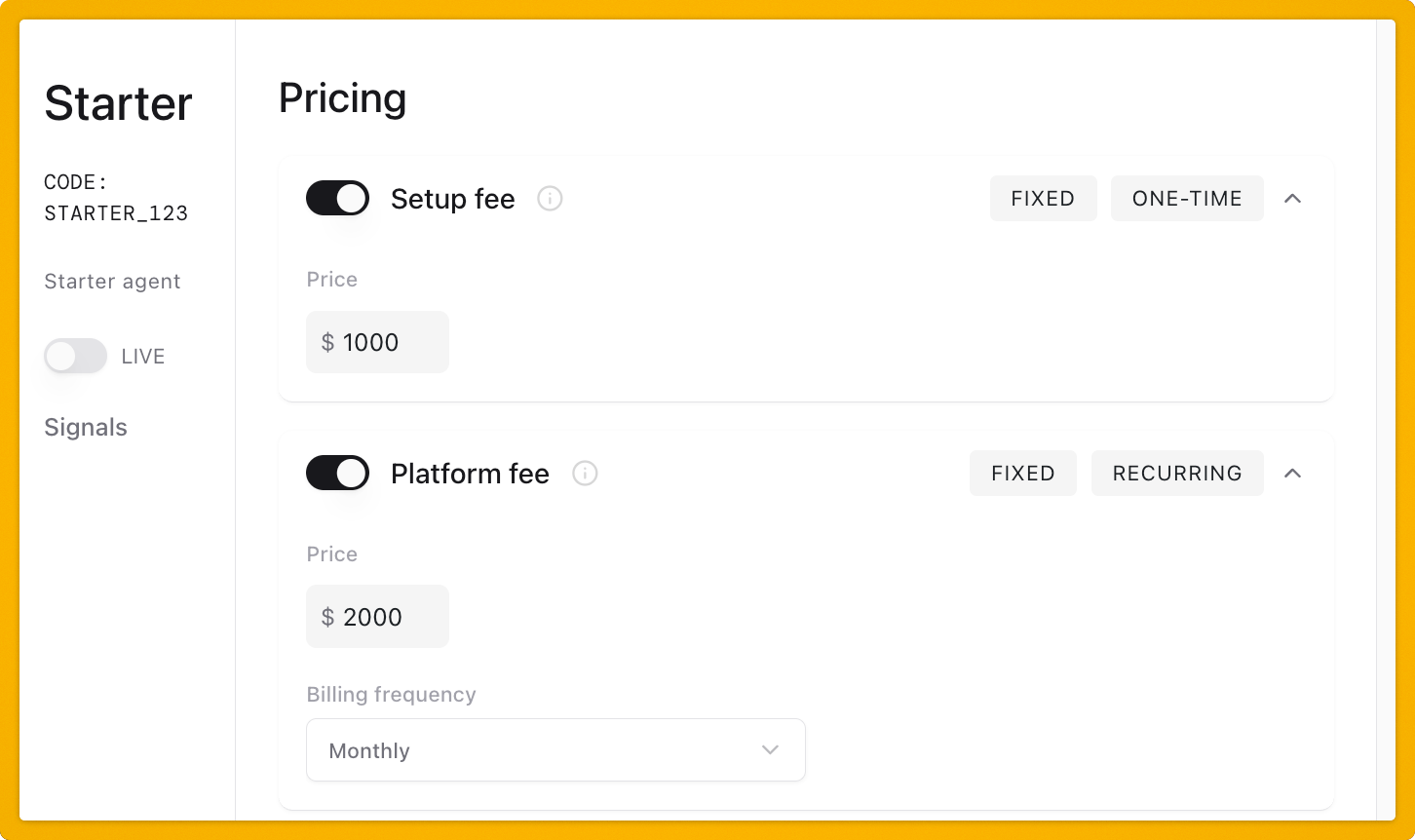

Step 3: Configure in Paid

Real-World Examples from our customers

Example 1: Legal Document Review agent

Agent: AI Legal Assistant for contracts

- Functionality: Reviews contracts, identifies risks, suggests edits

- Pricing Model:

- Starter: $3,000/month (up to 50 contracts)

- Professional: $8,000/month (up to 200 contracts)

- Enterprise: $20,000/month (unlimited contracts, API access)

- Why it works: Law firms have predictable document volumes and prefer fixed costs for budgeting

Example 2: Customer Success agent

Agent: Churn protection / retention AI

- Functionality: Monitors customer health, predicts churn, automates interventions

- Pricing Model:

- Small Business: $1,500/month (up to 500 customers)

- Growth: $5,000/month (up to 2,500 customers)

- Scale: $15,000/month (up to 10,000 customers)

- Why it works: SaaS companies want predictable costs tied to their customer base size

When to choose agent-based pricing

- ✅ Your agent performs a comprehensive set of tasks replacing a job function

- ✅ Customers want budget predictability from headcount allocations

- ✅ You can demonstrate clear FTE replacement value

- ✅ Competition prices on seat-based models

- ✅ You want to avoid race-to-bottom pricing pressure

⚠️ Future-proofing tip: As LLM costs drop 10-100x, shift your value prop from "cheaper than human" to "vastly more capable than human"

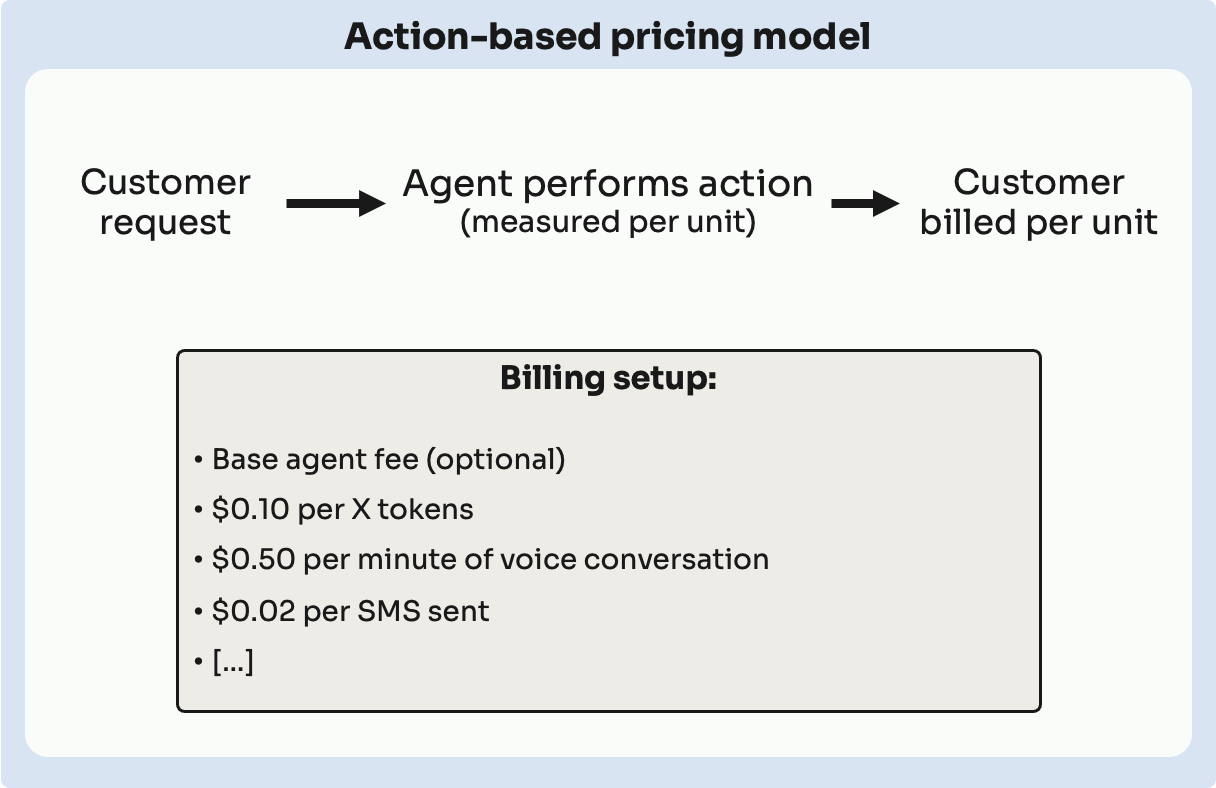

Action-based pricing

Action-based pricing charges customers for every discrete action their agents perform.

Used by agentic companies like Bland and Parloa, this consumption model mirrors cloud infrastructure and BPO pricing.

It's transparent but vulnerable to commoditization as AI costs decline.

How It Works

Pricing principles

- Transparent Consumption: Direct correlation between usage and cost

- Low Barrier to Entry: Customers only pay for what they use

- BPO Competition: Target the $900/employee BPO market

- Volume Discounts: Incentivize higher usage with tiered pricing

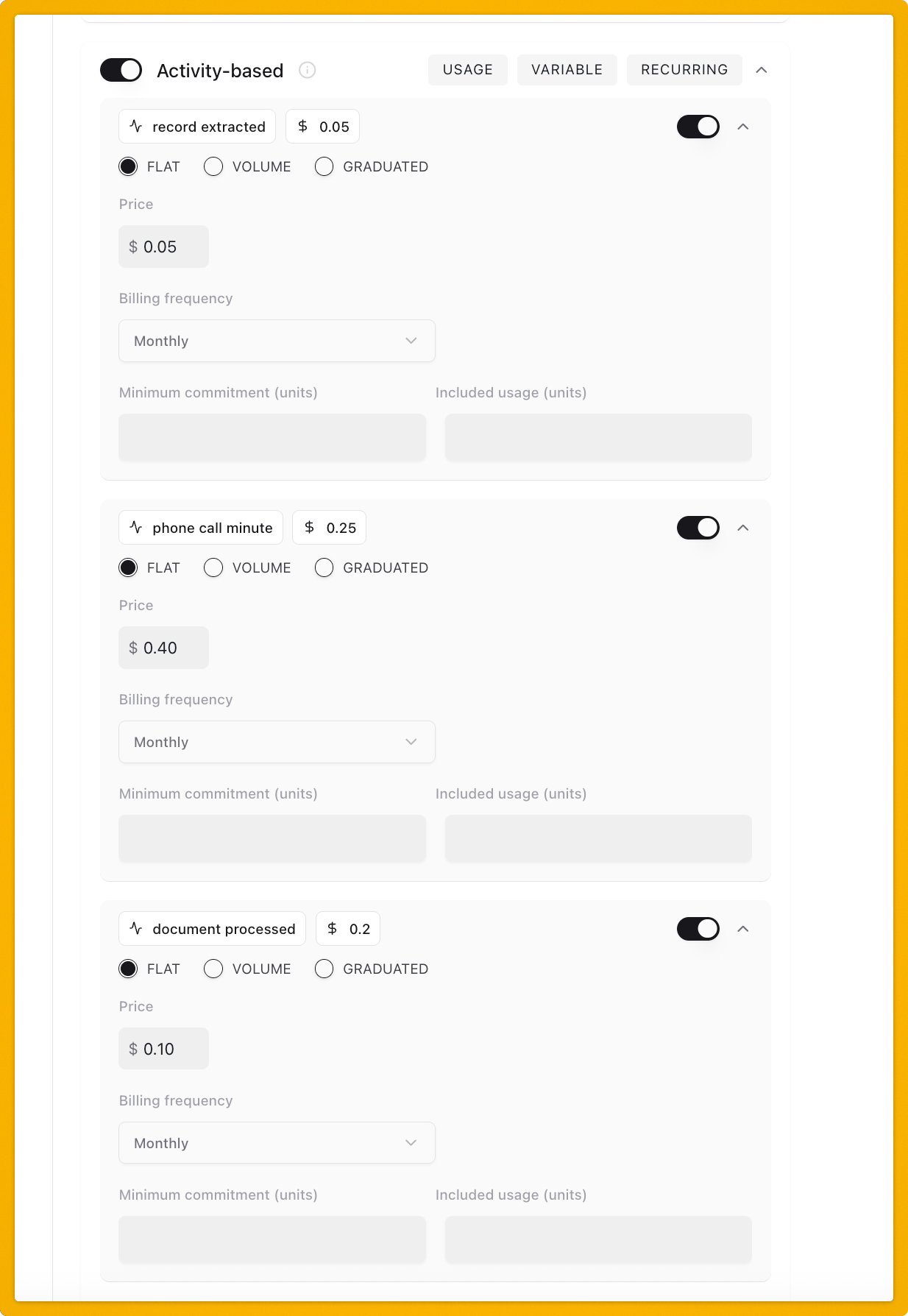

Implementation guide

Step 1: Calculate unit economics

- Determine base LLM/infrastructure costs

- Add 50-300% margin based on value delivered

- Build in cushion for future cost reductions

Step 2: Define billable actions

Real-World Examples

Example 1: AI Voice Agent (Bland.ai Model)

Agent: Call AI

- Functionality: Handles inbound customer service calls

- Pricing Model:

- $0.12/minute for inbound calls

- $0.18/minute for outbound calls

- Volume discounts: 10% off at 10,000 minutes/month

- Why it works: Direct competition with call centers at 70% lower cost

Example 2: Document Processing Agent

Agent: Document parsing AI

- Functionality: Extracts data from invoices, receipts, contracts

- Pricing Model:

- $0.10 per page processed

- $0.02 per data field extracted

- Bulk pricing: $500 for 10,000 pages/month

- Why it works: Clear unit economics vs. manual data entry costs

When to Choose Action-Based

- ✅ Competing directly with BPOs or call centers

- ✅ Highly variable usage patterns

- ✅ Customers want "pay only for what you use"

- ✅ Simple, discrete, measurable actions

- ✅ Testing market fit with low commitment

⚠️ Warning: This model faces the highest pricing pressure as AI costs plummet. Plan to transition to workflow or outcome-based pricing within 12-18 months.

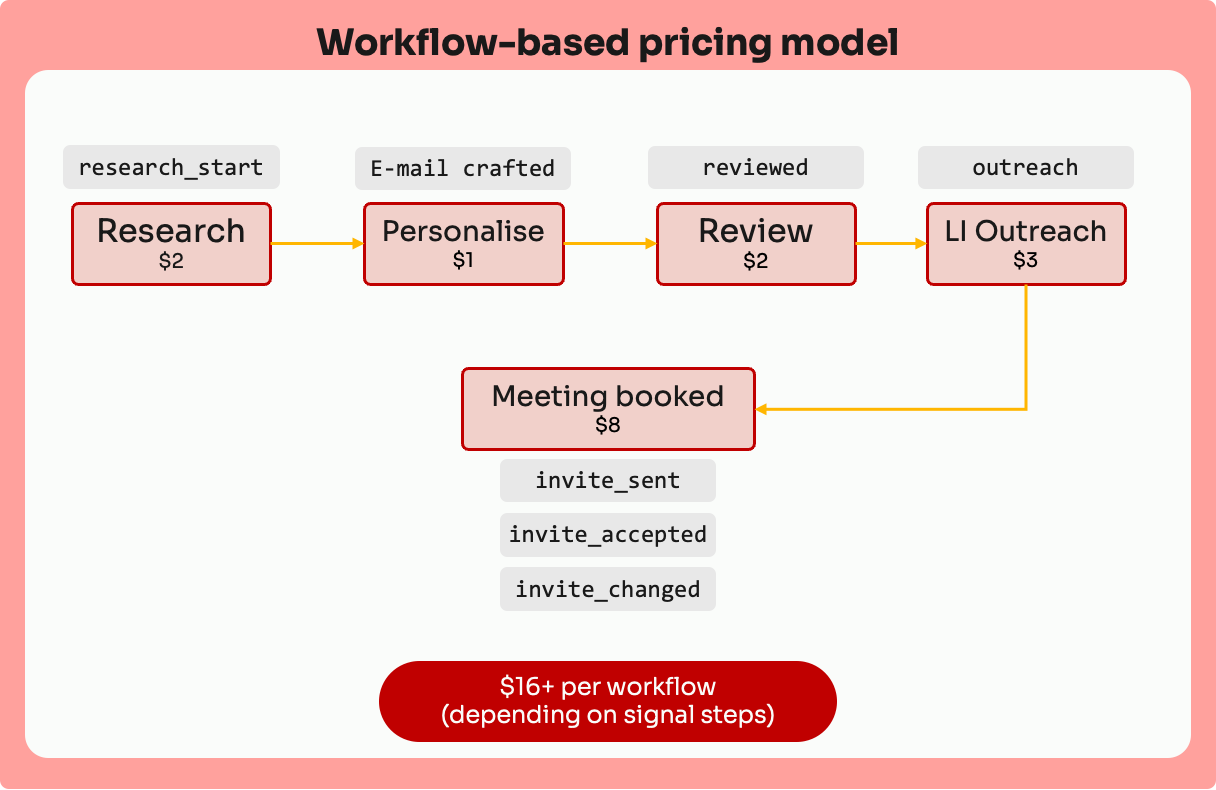

Workflow-based pricing

Workflow-based pricing charges for complete sequences of agent actions that deliver specific intermediate outcomes.

Companies like Rox, Salesforce, and Artisan use this model to balance between pure consumption and outcome pricing. Each workflow represents a meaningful business process with clear deliverables.

How It Works

Design Principles

- Process-Level Value: Price complete workflows, not individual actions

- Complexity Protection: Complex workflows resist commoditization

- Clear Deliverables: Each workflow produces measurable intermediate outcomes

- Margin Management: Monitor workflow costs to avoid negative margins on complex processes

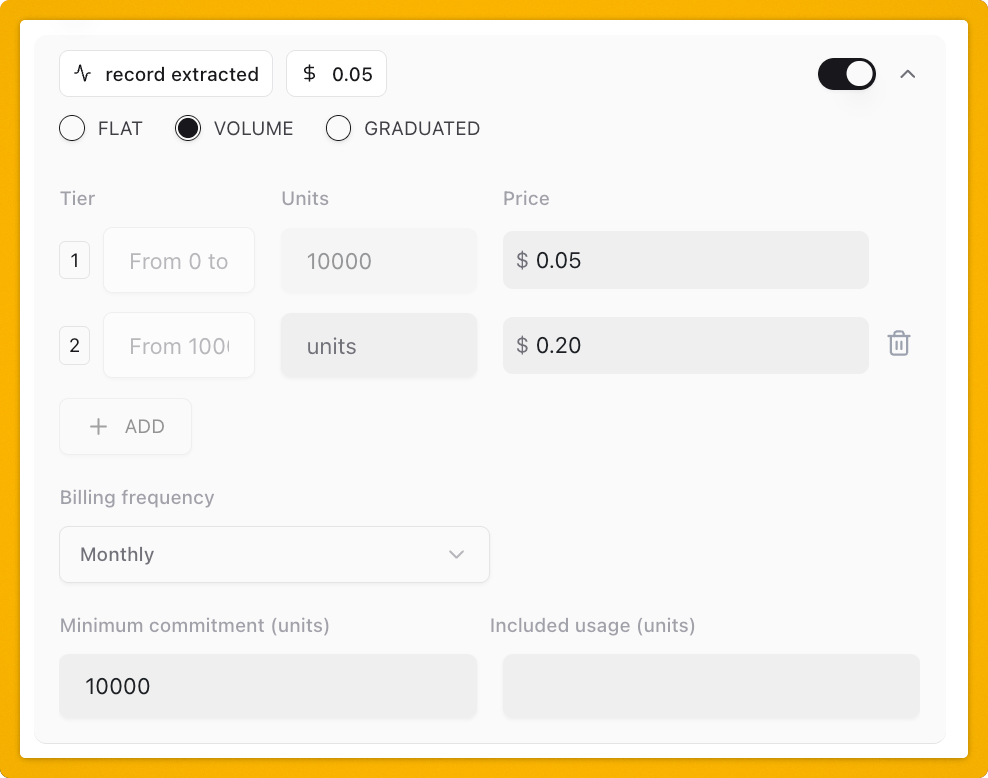

Implementation Guide

Step 1: Map your workflows

You want to identify the actions and assign some values to the steps.

- Identify all discrete actions your agent performs

- Estimate resource consumption per workflow

- Assign business value to each workflow

Step 2: Design pricing structure

Here, you set prices to cover your margins and costs.

- Set base platform fee (covers overhead)

- Price each workflow based on:

- Computational cost

- Business value delivered

- Market alternatives

Step 3: Add commitment tiers

Commitment tiers and included quantities are easy ways to force a minimum revenue, but they can backfire if you don’t explain to your customer what they get.

Here’s how you set them in Paid:

Real-World Examples

Example 1: Sales Development Representative (SDR) Agent

Agent: Automated SDR

Hybrid setup:

- Base platform fee: $3,000/month (platform access)

- Workflow pricing:

- Lead Research: $2 per lead profiled

- Email Personalization: $1 per email crafted

- LinkedIn Outreach: $3 per connection request

- Meeting Booking: $8 per meeting scheduled

- Optional commitment packages:

- Starter: 500 leads/month minimum ($5,000 guaranteed revenue)

- Growth: 2,000 leads/month minimum ($2,500 guaranteed revenue)

- Scale: 10,000 leads/month minimum ($5,000 guaranteed revenue)

- Why it works: Sales teams can start small and scale with success

Example 2: Financial Analysis Agent

Agent: Automated CFO Assistant

Hybrid setup:

- Base platform fee: $5,000/month

- Workflow Pricing:

- Report creation: 20 included, $100 for every overage

- Cash Flow Forecast: $250 per forecast

- Budget vs Actual Report: $50 per department

- Board Deck Generation: $500 per deck

- Real-time Dashboard Update: $25 per refresh

- Optional volume discounts: 20% off after 50 workflows/month

- Why it works: Finance teams have varying needs throughout the month/quarter

When to Choose Workflow-Based

- ✅ Your agent executes multi-step processes with clear deliverables

- ✅ Workflows are standardized but complex enough to avoid commoditization

- ✅ You can demonstrate ROI for each workflow type

- ✅ Different workflows deliver different business value

- ✅ You want pricing flexibility between action and outcome models

⚠️ Watch Out For:

- Complex workflows (document parsing, security scans) risk negative margins. Make sure you segment your workflows for length or complexity to avoid having your margins crushed.Monitor costs carefully to maintain profitability!

Outcome-based pricing

Outcome-based pricing represents the pinnacle of value-aligned pricing and the model most resistant to commoditization.

Companies like Zendesk, Intercom, Airhelp, and Chargeflow charge only for successful business results. As we note in our frameworks article with Kyle Poyar,, this model will likely dominate as AI costs plummet.

It's the only model that completely decouples pricing from underlying technology costs.

How It Works

This model is similar to the workflow-based pricing model. Even though you can combine it with a platform fee and others, you should avoid pricing individual “attempts”.

Has there been success? Bill.

No success? Don’t charge.

Design Principles

- Results-only focus: Charge only for achieved outcomes, not attempts.

- Clear attribution: Develop robust methodologies to prove your impact

- Shared risk AND reward: Include performance guarantees or success bonuses, like revenue share.

- Premium positioning: Command highest prices through guaranteed results

- Future-proof: This model is the most resistant to AI commoditization

Implementation guide

This model is the trickiest to get right, so follow carefully!

Step 1: Define success metrics

- These must be objectively measurable

- Directly tied to business value for best success

Step 2: Calculate Risk-Adjusted Pricing

- Estimate success rate of your agents

- Add risk premium (typically 30-50% with most of our customers)

- Include a base platform fee to cover operational costs if no success is reached

Setup in Paid is similar to the workflow setup, but prioritizes outcomes and not just actions.

Real-World Examples

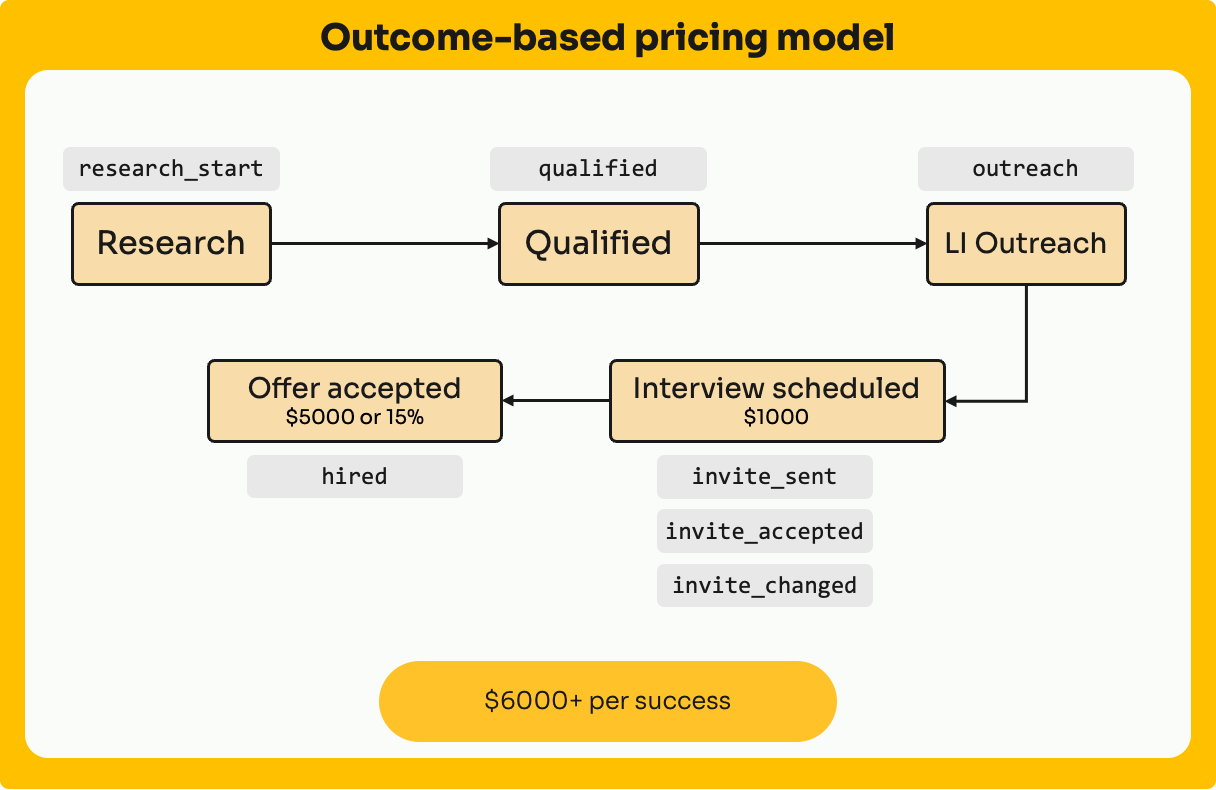

Example 1: Recruiting Agent

Agent: Automated Recruiter

- Base Fee: $2,000/month (platform access, unlimited searches)

- Outcome Pricing:

- Qualified Candidate Submitted: $500

- Interview Scheduled: $1,000

- Offer Accepted: $5,000 or 15% of first-year salary

- Success Metrics:

- Interview: Candidate completes first round with hiring manager

- Offer Accepted: Candidate signs offer letter

- Why it works: Recruiting is already outcome-based; AI agent follows industry model

Example 2: E-commerce Optimization Agent

Agent: Conversion Rate Optimizer

- Base Fee: $500/month (A/B testing infrastructure)

- Outcome Pricing:

- Conversion Rate Improvement: $2,000 per percentage point

- Revenue Increase: 5% of incremental revenue

- Cart Abandonment Reduction: $50 per recovered cart

- Success Metrics:

- Conversion: Measured via integrated analytics, 30-day attribution

- Revenue: Year-over-year comparison, seasonally adjusted

- Cart Recovery: Completed purchase within 7 days of intervention

- Caps: Maximum $50,000/month to prevent runaway costs

- Why it works: Direct tie to revenue makes ROI crystal clear

When should you choose Outcome-based pricing?

- ✅ Success can be clearly measured and attributed

- ✅ Your agent consistently delivers quantifiable results

- ✅ Market already expects outcome-based pricing (e.g., recruiting, sales)

- ✅ You want maximum pricing power and differentiation

- ✅ You're confident in your agent's performance

💡 Tip: This is the most future-proof model. As AI costs approach zero, outcome-based pricing maintains margins by focusing on value delivered, not resources consumed.

Paid’s best practices for agent monetization

1. Start simple, evolve sophisticated

- Launch with agent-based pricing

- Add usage components as you learn

- Introduce outcomes once proven

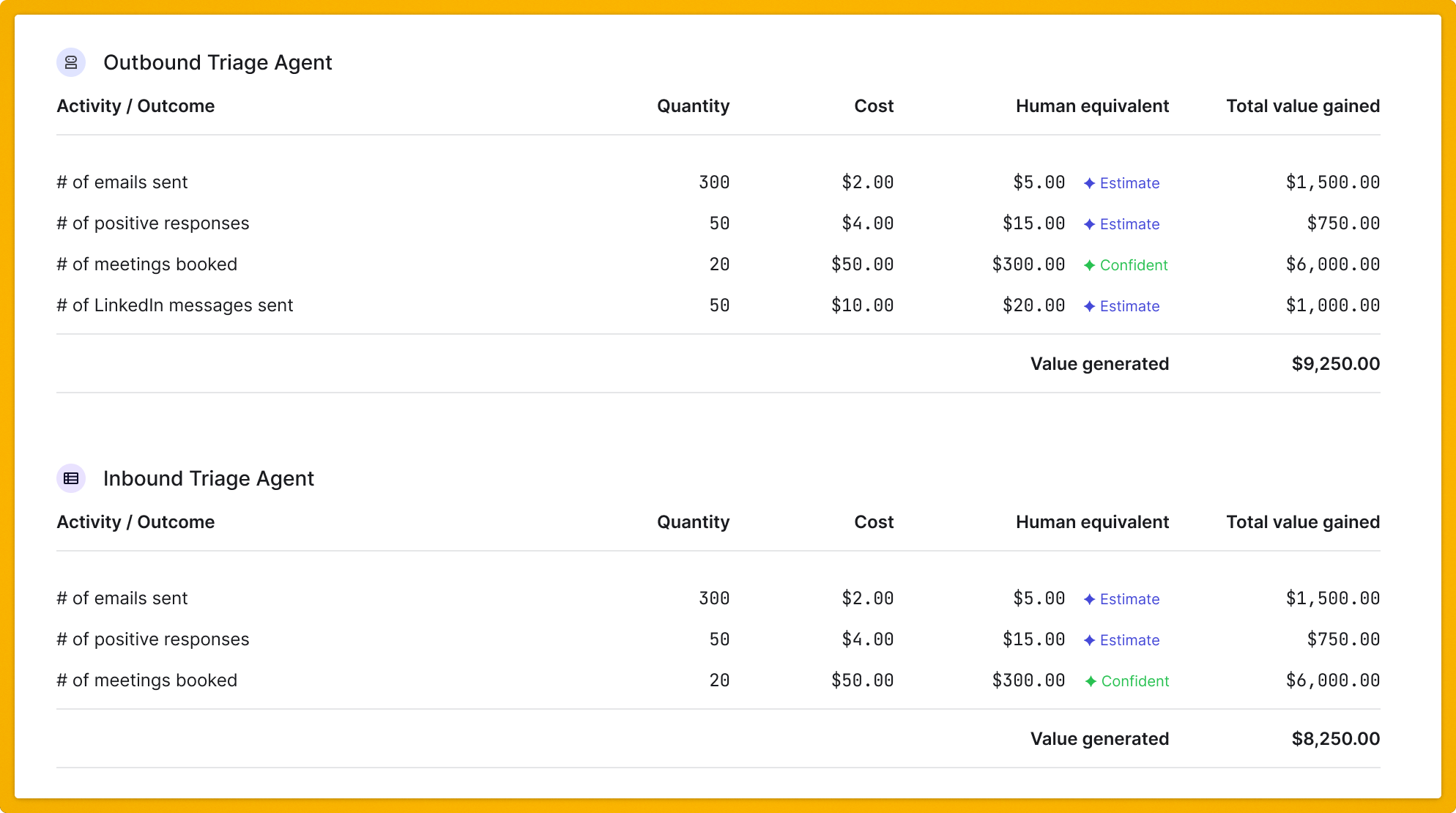

2. Transparency builds trust

- Real-time usage dashboards

- Clear billing breakdowns and value receipts

- Proactive cost alerts

3. Price for value (not cost)

- Research alternative solutions

- Understand customer budgets

- Price below human equivalent

- Leave room for discounting

4. Monitor and iterate - experiment frequently

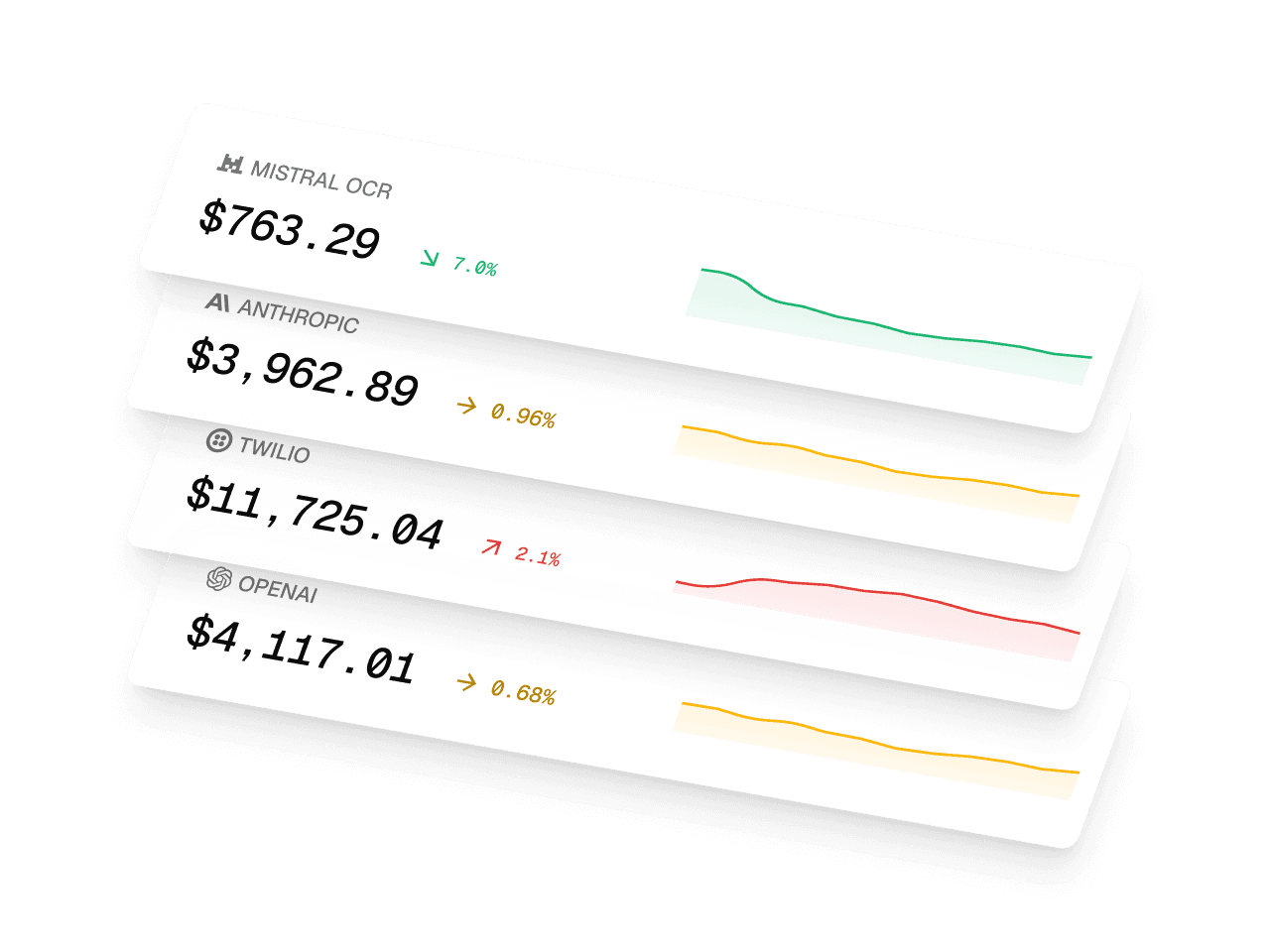

- Track key metrics:

- Customer acquisition cost

- Lifetime value

- Churn rate by pricing model

- Usage patterns

- A/B test pricing changes

- Survey customers quarterly - not just those who churn

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes