When companies build (and deploy) AI agents, they often focus on capabilities first and economics second.

This is a bit like hiring employees based solely on their skills without considering their salary requirements. It’s possible, but it’s a recipe for trouble down the line.

AI agents consume resources every time they perform tasks. They use computing power, make API calls, LLMs, text-to-speech, avatars, and so much more.

All of these elements cost real money - much more than a SaaS. These costs scale not just with usage, but also with the type of inputs in ways that aren't always predictable or linear.

The agentic margin (AM) and agentic margin ratio (AMR) are practical measures that tells you whether your investment in AI is actually creating value or quietly draining your resources.

In our recent conversations we have seen too many companies rush to implement AI agents only to pull back months later when they realize the agents cost more to operate than the value they create.

Without tracking agentic margin from day one, these issues often remain hidden.

What makes agentic margin different from other metrics (including SaaS metrics)?

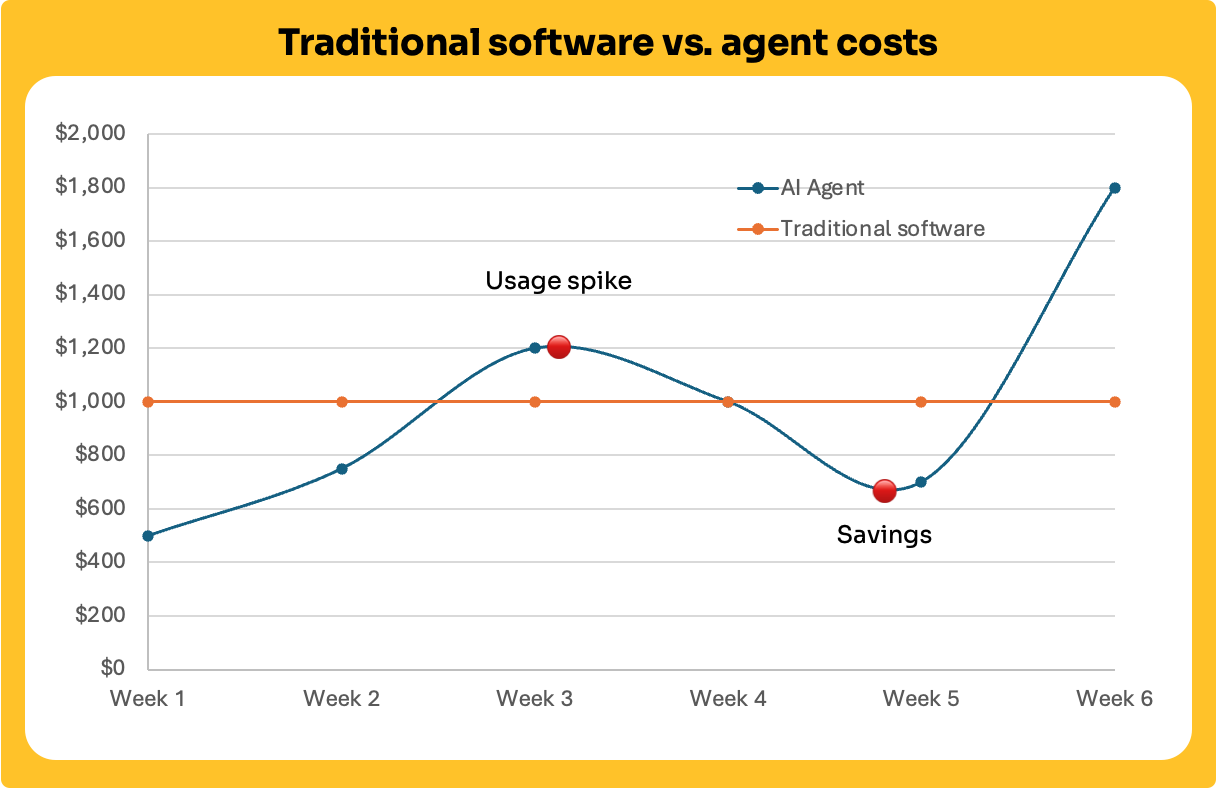

Unlike traditional software that has predictable licensing costs, AI agents have a unique economic profile:

- They typically charge by usage (tokens, API calls, compute time)

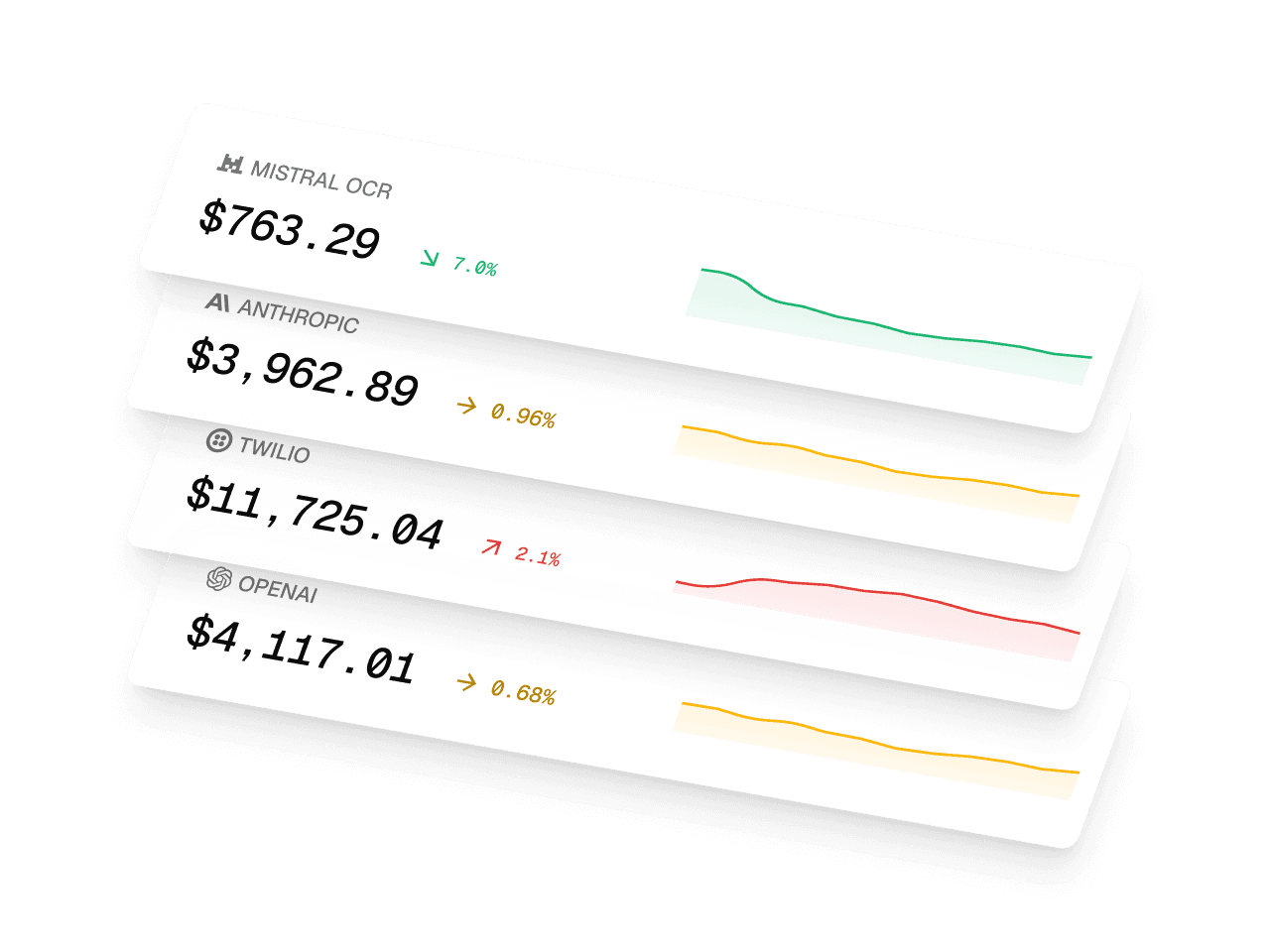

- They consume multiple services simultaneously

- Their costs fluctuate based on task complexity

- Their usage patterns can change as user behavior evolves

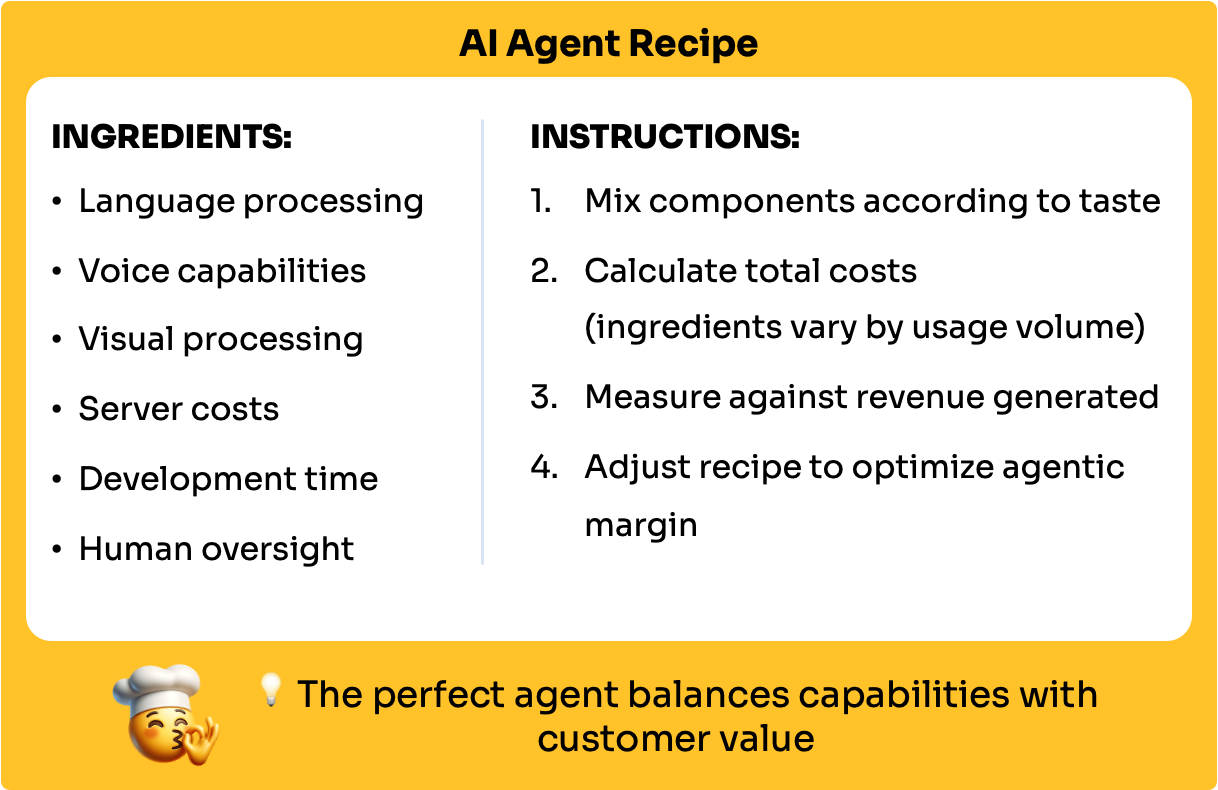

The Components of Agent Costs

To calculate your agentic margin accurately, you need to understand all the ingredients that contribute to your agent's operating costs:

- Language models: The "thinking" capabilities of your agent

- Voice processing: Converting speech to text and text to speech

- Visual capabilities: Understanding or generating images

- Infrastructure: Servers and data storage

- Development: Building and improving your agents

- Human oversight: People who monitor and train agents

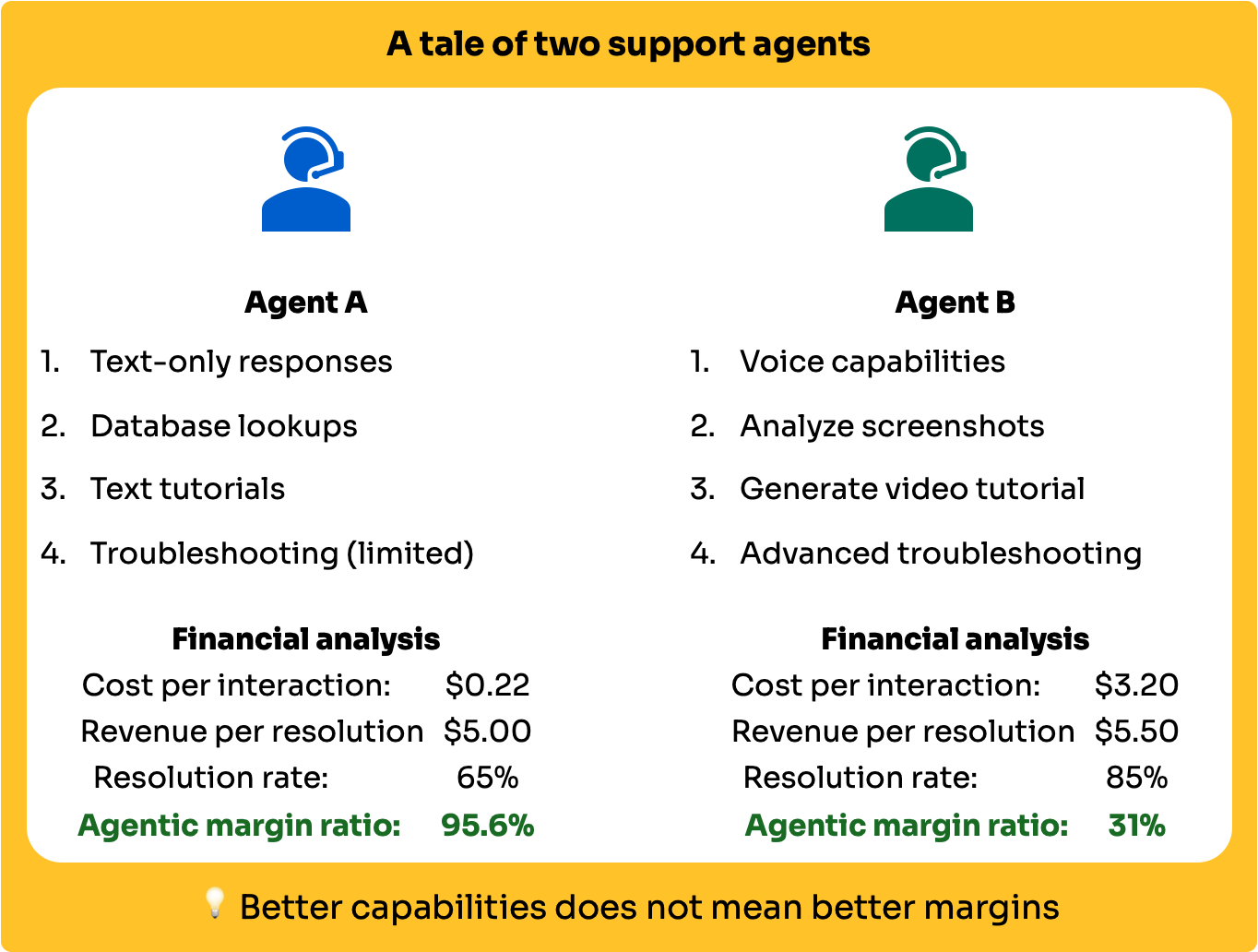

A Tale of Two Support Agents

Here is a real example (with details scrubbed) that we encountered when helping a software company evaluate their customer support agents:

Agent A used meager resources, sticking to text-only responses and simple database lookups. It cost about $0.22 per customer interaction while resolving 65% of tickets without human intervention, while bringing in $5 per resolved ticket in revenue.

Agentic Margin (AM): $5 - $0.22 = $4.78. That's an AMR of 95.6%. VERY healthy!

Agent B used advanced features: voice capabilities, screenshot analysis, and could generate tutorial videos on demand. It cost $3.20 per interaction but resolved 85% of tickets, resulting in $5.50 revenue per resolved ticket.

Agentic Margin (AM): $5.50 - $3.20 = $2.30, with an AMR of 31% - much lower than that of Agent A.

Even when considering the resolution rate, and assuming only resolved tickets get you paid, you’d still be making a better profit:

When building these agents, the company focused only on resolution rates and almost standardized on Agent B before realizing that Agent A's superior agentic margin made it a better value for deploying at a greater scale.

It’s also true that as the cost of LLMs and tools go down, Agent B’s margins could improve.

That’s why you have to continuously check the health of your agents, with different variants and models.

Try this today: Making your agents healthier

Here are some practical ways to improve your agentic margin:

- Right-size your capabilities: Match agent features to actual user needs. If you are not sure which features/abilities get used, start tracking sooner rather than later.

- Continuously monitor capabilities: As models get cheaper or develop new capabilities, you should have a continuous check of your agents’ metrics. You could be underpricing and overdelivering (or vice-versa).

- Cache common responses: Don't regenerate the same answers repeatedly to prevent expensive API access

- Set sensible guardrails: Prevent unnecessary use of expensive capabilities. Don’t allow users to paste in very long texts or very large images.

- Monitor usage patterns: Watch for inefficient processes or unexpected costs. If you can’t monitor this on a per-interaction base, at least try to understand global usage patterns.

Remember This

The companies that succeed with AI won't necessarily be those with the most advanced capabilities, but those who understand the economic realities of deploying AI at scale. By tracking and optimizing your agentic margin, you're not just counting pennies, you're building a sustainable foundation for AI that actually delivers on its promise.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes