We've stopped asking CEOs about their AI pricing strategy. It's the wrong question.

Instead, we ask one simple thing: "How are your reps actually selling it?"

The answer tells us everything we need to know about whether they'll survive the next twelve months.

- "Custom deals." Translation: We have no idea what we're doing, so every conversation is a one-off negotiation that takes six weeks to approve.

- "We're still figuring it out." Translation: Our reps are making it up as they go, probably losing deals while RevOps scrambles to build something, anything, that works.

- "Same as our other products." Translation: We're forcing AI agents into seat-based pricing and hoping nobody notices the fundamental mismatch.

The pricing strategy question is constraining. It assumes you have one. But asking how reps are selling reveals the truth: positioning problems, process gaps, and the painful reality that most companies have no repeatable playbook for selling autonomous software.

Your reps aren't incompetent. They're improvising!

Every deal becomes a custom negotiation because there's no standard way to sell something that doesn't fit in a seat

Your sales aren’t the villain

We’ve heard CEOs complain "why we're still selling seats for autonomous agents" - and it's tempting to point fingers at sales but this really isn’t a sales problem.

Your reps very likely are not lazy. They're stuck with the only model your systems can actually operationalize.

Your deal desk/RevOps is probably stretched thin.

Some numbers say there’s one RevOps person for every 108 employees. That one person isn't building modern billing infrastructure but focusing on the tactical approvals, spreadsheets, and Slack pings from Sales asking, "Can we please just do usage-based pricing for this one deal?"

The answer is always no. Not because RevOps doesn't want to help. Because the infrastructure doesn't exist.

So your sales team defaults to what's safe and won't require six weeks of change management.

What it looks like for your numbers

I think we’ve all seen what happens when you try to squeeze agents into old SaaS pricing boxes.

- GitHub Copilot charges $10/month but heavy users cost Microsoft $80/month. Average loss: $20 per user. Annual bleeding: $240 million. But it’s fine because Microsoft subsidizes that.

- OpenAI brings in $4 billion in revenue but burns $5 billion in compute.

- Chegg lost 90% of its market cap when students realized AI could answer their homework questions. Sadly went from education platform to cautionary tale in months.

- Stack Overflow watched questions drop 64% and engagement fall 25% because developers ask ChatGPT instead of humans now.

Selling agents is harder than it looks

At face value "just charge for usage" or "sell outcomes" sounds simple. We know we’ve been preaching it - but it is actually a bit difficult.

Some AI agents send 50 emails, analyzes 200 accounts, makes 13 LinkedIn touches, then books one meeting. So which action should the customer pay for?

If you’re not sure, your customer surely won’t know and you definitely haven’t set it up right.

A BCG report called Rethinking B2B Software Pricing in the Agentic AI Era found that 25% of buyers can't figure out value attribution for AI. Another 24% say outcomes depend on factors completely outside vendor control.

What you need to get set-up

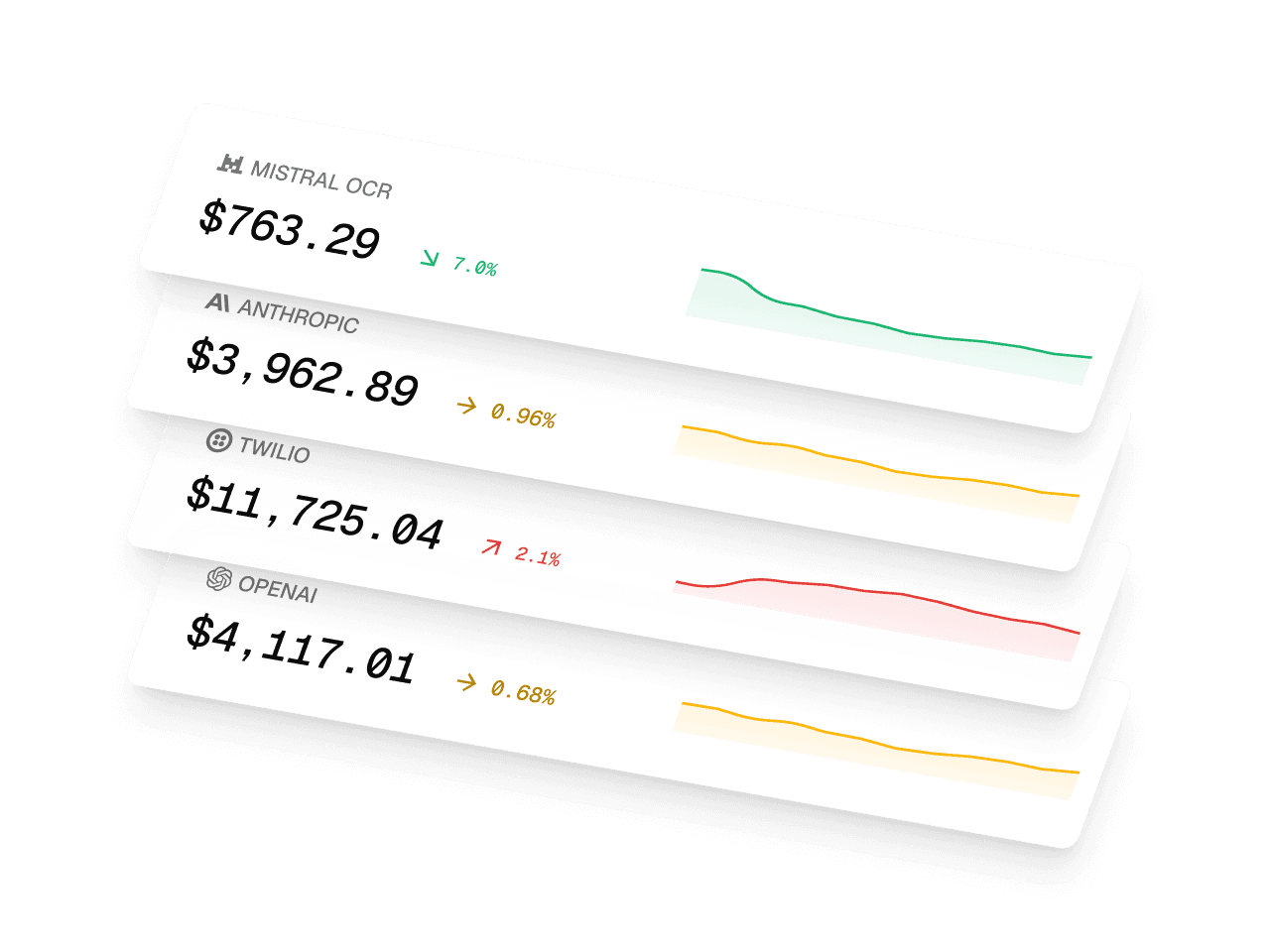

Agent-level tracking that knows which customers drive costs and which drive value. Without this, you're flying blind with a flamethrower attached to your bank account.

Attribution that makes sense. Was it the 50th email or the 13th LinkedIn touch that closed the deal? Without proper tracking, you're just making expensive guesses.

Hybrid pricing flexibility. Base fees plus usage plus outcomes. You need all three to bridge from seats to value-based models. Your current billing system offers exactly none.

Real-time margin visibility. LLM costs swing by 70 percentage points across accounts. One customer is profitable. Another is killing your P&L. You have no idea which is which.

Who's Actually Getting This Right

While everyone else bleeds, three companies cracked the code:

- Clay achieved 6x revenue growth and a $1.25B valuation with credit-based pricing. Customers buy credits upfront with no surprise bills, and probably not much margin destruction.

- Intercom generates tens of millions charging $0.99 per resolution. They defined "resolved" clearly: customer marks it done or doesn't return in 48 hours. No philosophy degree required!

- Sierra hit $20M ARR in under a year by pricing directly on outcomes, with cost savings and revenue generated. That’s real business impact.

None of them jumped straight from seats to outcomes. That could destroy their businesses.

Instead, they built hybrid models on the path to outcomes. They tested attribution systems, and transitioned in stages. They also built the infrastructure first, then figured out pricing, then launched.

You're probably doing it backward.

The human-emotional layer

Your sales leaders feel trapped selling something they know doesn't align with customer value. They hear "we want usage-based pricing" ten times a day and have to respond with "let me see what we can do" knowing the answer is nothing (or a month long delay to get that hacked into the system)

Then RevOps leaders feel guilty blocking creative pricing ideas because the systems can't support them. They're not trying to be the bad guy. They're just out of duct tape and prayers.

Then the CEO feels the pressure of investor promises about "AI monetization" while staring at ops infrastructure from 2015. Board meetings are getting awkward.

Underneath it all is this quiet fear: What if we launch and the whole model collapses, or we’re universally panned for thec hange?

Chegg proves it can happen. Stack Overflow proves it is happening.

Your model will break, the only question is when.

The bridge from here to there

You can't flip from seats to usage overnight - and yet you can't stay where you are either.

Start with hybrid models. Keep a base platform fee (procurement understands this) but add usage components for actual agent work. Your sales team can still forecast something. Customers get flexibility.

Pick one value metric that matters.

Build the infrastructure before you need it. Not after your sales team has already lost fifty deals to competitors who got there first.

The Question That Matters

“How will you offer to your customers a way to pay that matches the value they receive?”

That’s it.

If you can't offer that, someone else will. And probably already is.

Your infrastructure may be failing you, which leads your teams to be frustrated.

Until you can track, attribute, and flex pricing around agent value, you're fighting with one hand tied behind your back.

So let me ask again. Are you selling agents the way customers want to buy them?

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes