As part of our Paid Roundtable series, we again hosted AI founders and Ops professionals to discuss why CFOs hate AI pricing.

Here's what we learned from bleeding on the front lines:

The Excel issue

I started by saying what I've heard from other CFOs - "I don't know how to put usage components into Excel". I'm dumbing it down a bit, sure, but that's the gist of it.

Think about that. Procurement teams have been using the same forecasting models for 15 years. Fixed seats, fixed costs, nice clean cells. You show up with consumption pricing and their entire planning system breaks.

Another founder said another variant of this objection is "Something better could come out in 3-6 months", which probably means "I have no idea how to budget for this".

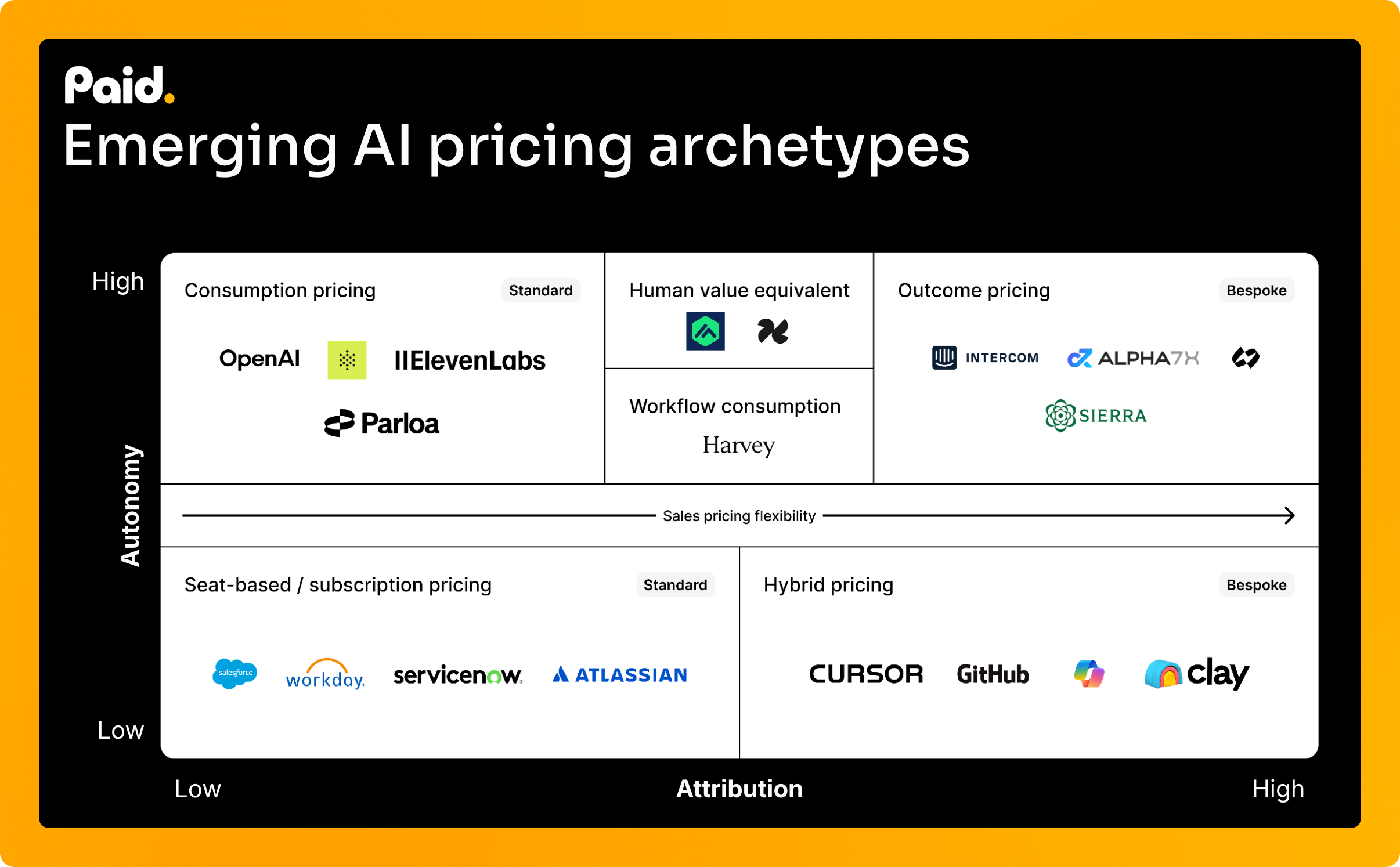

The 2x2 emerging pricing archetypes that determine your pricing model

Here's the framework that we showed during our discussion:

Attribution (Y-axis): Can you prove your impact? Autonomy (X-axis): Does your agent work independently?

High/High = Charge for outcomes High/Low = Workflow consumption pricing Low/High = Human equivalent pricingLow/Low = Stick to seats or usage

Most founders are trying to charge for outcomes when they're actually in the Low/Low quadrant.

Year one fixed, year two outcome

Our cofounder Manoj's playbook, which has worked across multiple deals, is to start with a fixed price year one to gather data and build trust. Then, on year two: renegotiate with their own data proving value.

The key insight: You're using year one as paid data collection. Every interaction, every outcome, every hour saved gets logged. When renewal comes, you have twelve months of proof. Contracts go from $100K to $500K because the value is undeniable.

This solves the CFO's predictability problem while setting you up for premium pricing.

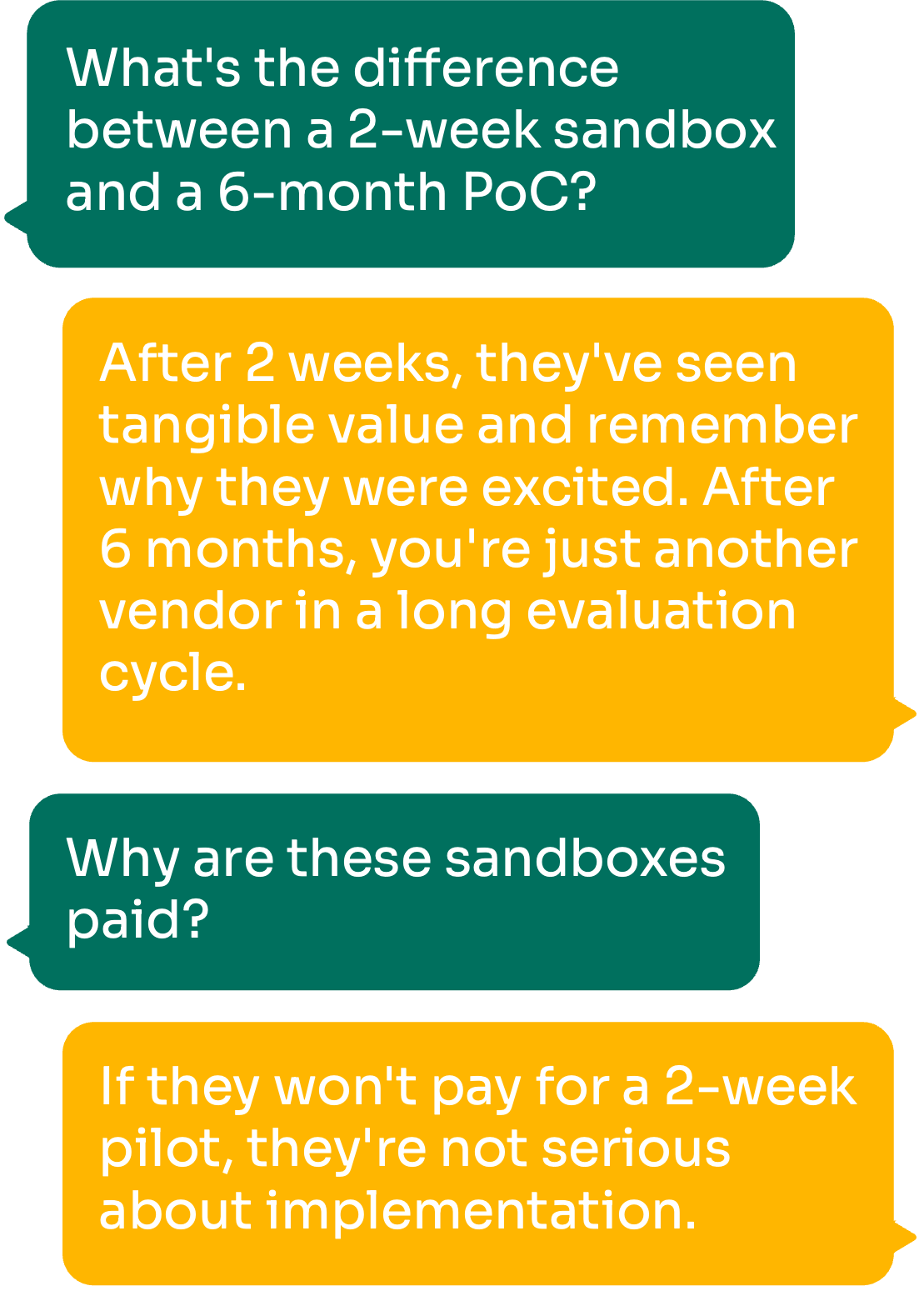

The 2-week sandbox strategy

Andrew from Dialog closes deals without a finished product. Ben from Covecta refined it further:

2-4 week sandbox. 3-5 users. Document every hour saved. Build the business case together.

Compare this to the typical 6-month PoC. After 2 weeks, they've seen tangible value and remember why they were excited. After 6 months, you're just another vendor in a long evaluation cycle.

The critical shift: These are paid sandboxes. If they won't pay for a 2-week pilot, they're not serious about implementation.

Canary metrics solve attribution

Tom Williams from Supercase introduced a concept that resonated, at least for me: canary metrics.

You can't always prove your AI drove revenue. But you can measure the indicators that correlate with outcomes:

- Drafts created per day

- Cases processed per week

- Tickets resolved without escalation

- Documents reviewed per hour

These are your canaries. They predict the outcome even when direct attribution is impossible.

Tom's approach: Start by pricing against these measurable outputs. Show the correlation to business outcomes over time. Graduate to outcome pricing once you've established the relationship with data.

Volume packs create predictability

This model which was brought up solves the Excel problem I raised elegantly:

- 10,000 agent tasks upfront

- 12-month commitment

- Overage charges for excess usage

- Tied to customer's business projections

CFOs get their fixed line item. You get usage-based reality. If they use more, it means they're getting more value and their business is growing.

The clever part: You're not capping value, you're packaging it.

What we took away

After an hour of comparing notes, the patterns for me were clear:

Paid sandboxes beat free pilots. 2-4 weeks of focused value discovery trumps 6 months of tire-kicking.

Canary metrics unlock pricing conversations. When you can't prove revenue impact, prove the activities that drive it.

Year one is about trust, year two is about value. Use fixed pricing to gather data, then graduate to outcomes.

Volume packages solve the Excel problem. Give CFOs a number they can put in a cell while maintaining usage flexibility.

The variable cost objection isn't really about cost. It's about predictability and control. Don't fight for the CFO's Excel model – work within it while building toward something better.

Thanks to everyone who's participated in our roundtable events so far.

We run these roundtables every 3 weeks. Sign up to our newsletter to stay on top of events, as well as our LinkedIn and Luma events.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

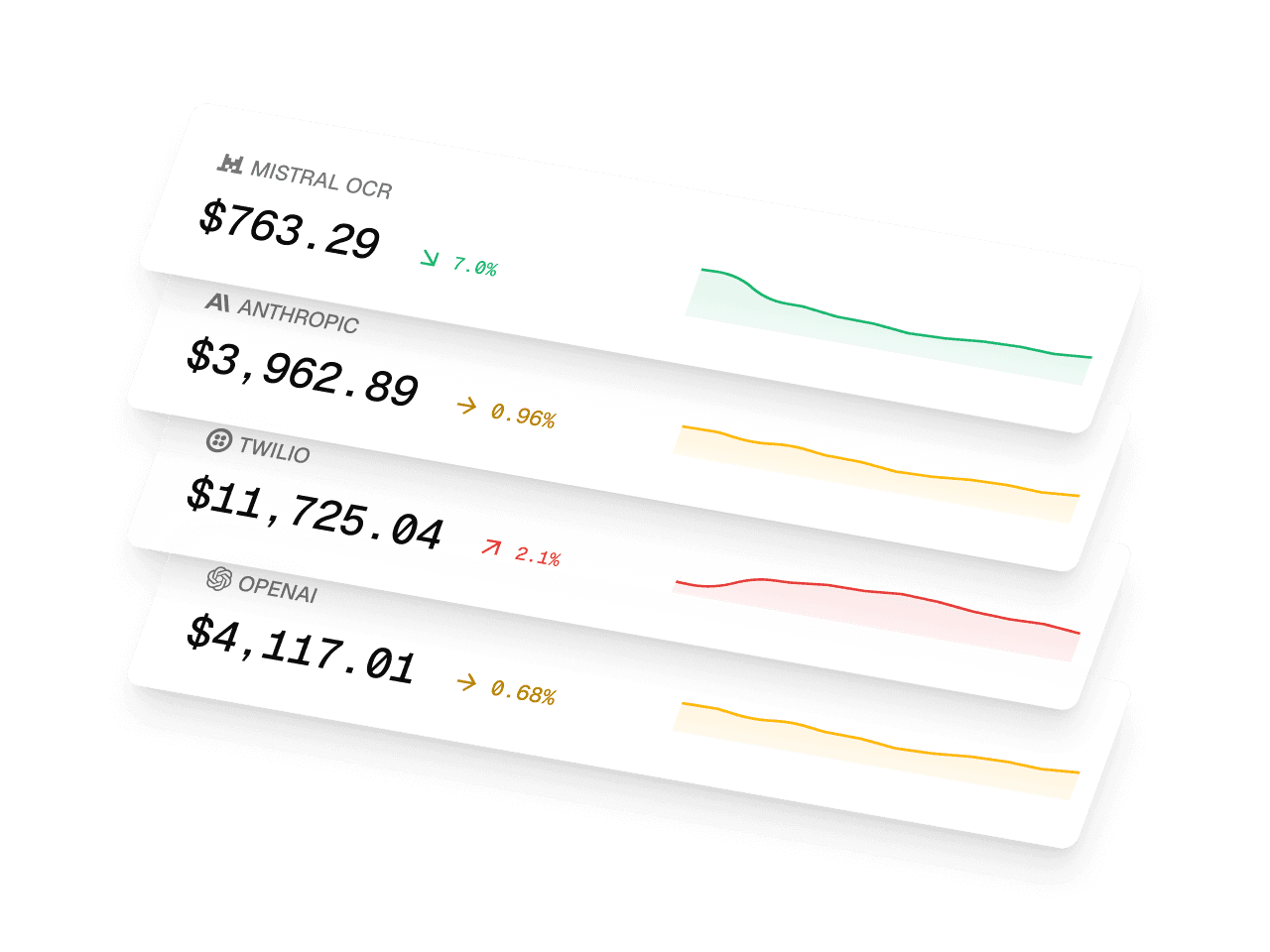

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes