SaaS is going through a crisis.

According to Aventis Advisors’ SaaS valuation report, growth rates have dropped from 33% pre-COVID to just 13% today.

Altimeter’s Jamin Ball says SaaS companies added $1.65bn net new ARR in Q1 2025, down from $2.33 billion in Q1 2024 - a year on year decline of 29%.

For an industry built on predictable, compounding growth, these figures signal a fundamental shift in how the SaaS market operates.

Billions of dollars in enterprise value are now trapped in what can only be described as SaaS no man's land.

It looks bleak, but some of the more innovative SaaS companies have realised that the solution to this crisis is already sitting in their data.

The hidden asset in every SaaS company

Your SaaS company possesses something that AI-native startups would pay millions for. You have years of workflow data, documented operating procedures, and institutional knowledge encoded. Customers have been teaching you how they work for years. You know their processes, their pain points, and their desired outcomes.

The companies pulling ahead right now are transforming this accumulated knowledge into AI agents that can execute work, not just assist with it.

More and more SaaS companies are launching AI features, or even entirely new AI products. But many of them are approaching AI pricing in the same way they priced features in 2015. And that's where billions in potential value are being left on the table.

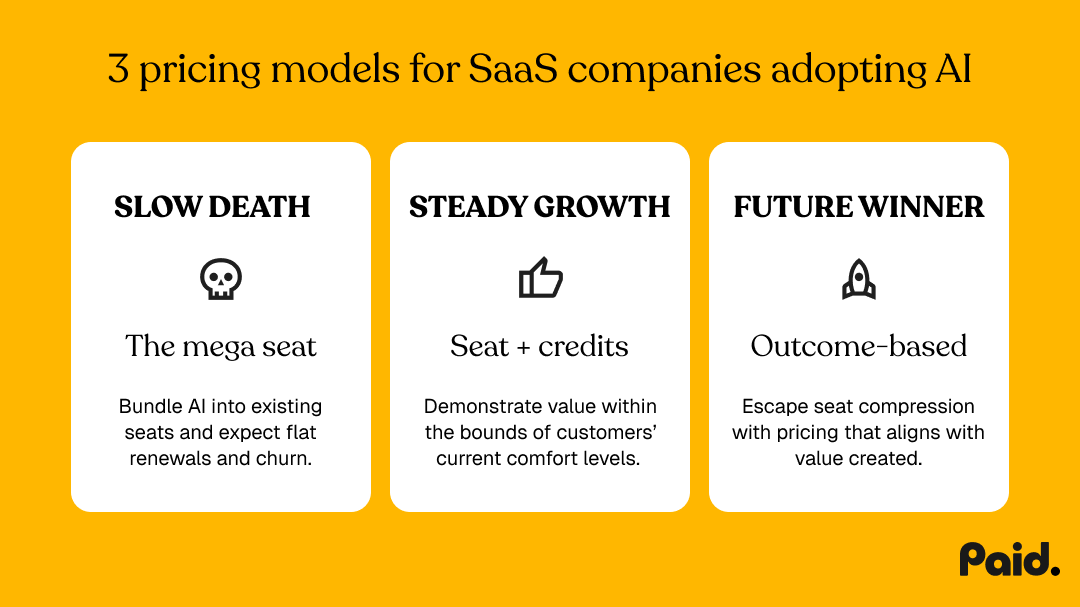

The pricing strategy that kills growth: The mega seat

When SaaS companies decide to "add AI," the default move is to bundle it into existing seat licenses at a premium price. It feels safe because it doesn't require rethinking your sales or customer success motions.

This is exactly the wrong approach.

Procurement teams are already cutting 10-20% of low-usage seats. Workforce reductions mean fewer potential buyers. It doesn’t make sense to respond to seat compression with bigger seats.

Your champion might buy in, but when they go to procurement, they’re going to be told to push for the premium tier at the same price they're paying today. You don’t agree? No problem, they’ll go elsewhere.

It might work in the short term, but in the long term, you end up with flat renewals or customer churn.

Today’s winner: Seat + credits

This is where many companies should start today.

The seat + credits model attaches AI consumption or outcome credits to your existing seat licenses.

Credits allow you to start demonstrating value without shifting to a complete outcome-based model. Done right, a seat + credits model will teach your customers how to buy differently, gradually shifting their mental model from productivity upticks per seat to value created at large.

The gotcha here is usage. If your customers aren’t spending their credits, they’ll downgrade, or even churn. To get past this, you need to retrain customers to use your AI features - no small feat when they’re comfortable with the old way.

If you don’t invest in driving adoption, you can bet that a new AI-native company will convince your champions that your 10-year old architecture is obsolete.

They'll position themselves as the future while you're still the past with AI sprinkled on top.

The SaaS winners will see this as an opportunity, using seat + credit models to move closer to a pure outcome-based world.

The future: Launch an AI-native product and charge for outcomes

For most companies, the ultimate destination is a standalone AI product with outcome-based pricing.

Adoption will be slower in some spaces than others.

Customer service agents like Fin and Sierra are using outcome-based pricing, charging per resolution of customer service inquiry. Some systems of record type products like CRM and ERP might have a harder time moving to outcomes. For these companies, it’s harder to define what outcomes might look like, and it’ll be harder still to educate customers to shift their mindsets to outcome-based pricing.

That said, companies that can launch new AI-native products and charge for outcomes will see massive benefits.

1. You own the category before competitors define it. When Intercom launched Fin as a distinct product, they didn't just add a feature, they claimed ownership of "AI customer service agent." That's a category they can defend for years.

2. Pricing aligns with value creation. When customers pay for outcomes (tickets resolved, reports generated, workflows completed) rather than seats, there's no argument about ROI. The product literally pays for itself in measurable terms.

3. Sales cycles collapse. Instead of navigating seat reallocation and budget shuffles, you're selling net new value. Finance teams don't need to approve a replacement, they're approving an investment that reduces costs elsewhere.

4. You escape the seat compression spiral. Your revenue is no longer tied to headcount. In fact, your product becomes more valuable when it helps customers do more with less, which is exactly what their boards are demanding.

Salesforce didn't just add AI features to Sales Cloud. They launched Agentforce as a distinct product because they understood that the buying motion, pricing model, and value proposition were fundamentally different.

Moving towards outcomes, even if you’re not there yet

The companies already making this shift are pulling ahead. The rest are still debating seat pricing while their ARR bleeds out.

Purely agentic products and outcome-based pricing aren’t for everyone, but the pendulum is swinging in that direction. Those who move fast and figure out how to package their data into AI agents, and price for value accordingly, will emerge as the leaders of the next wave of SaaS.

Get back to growth

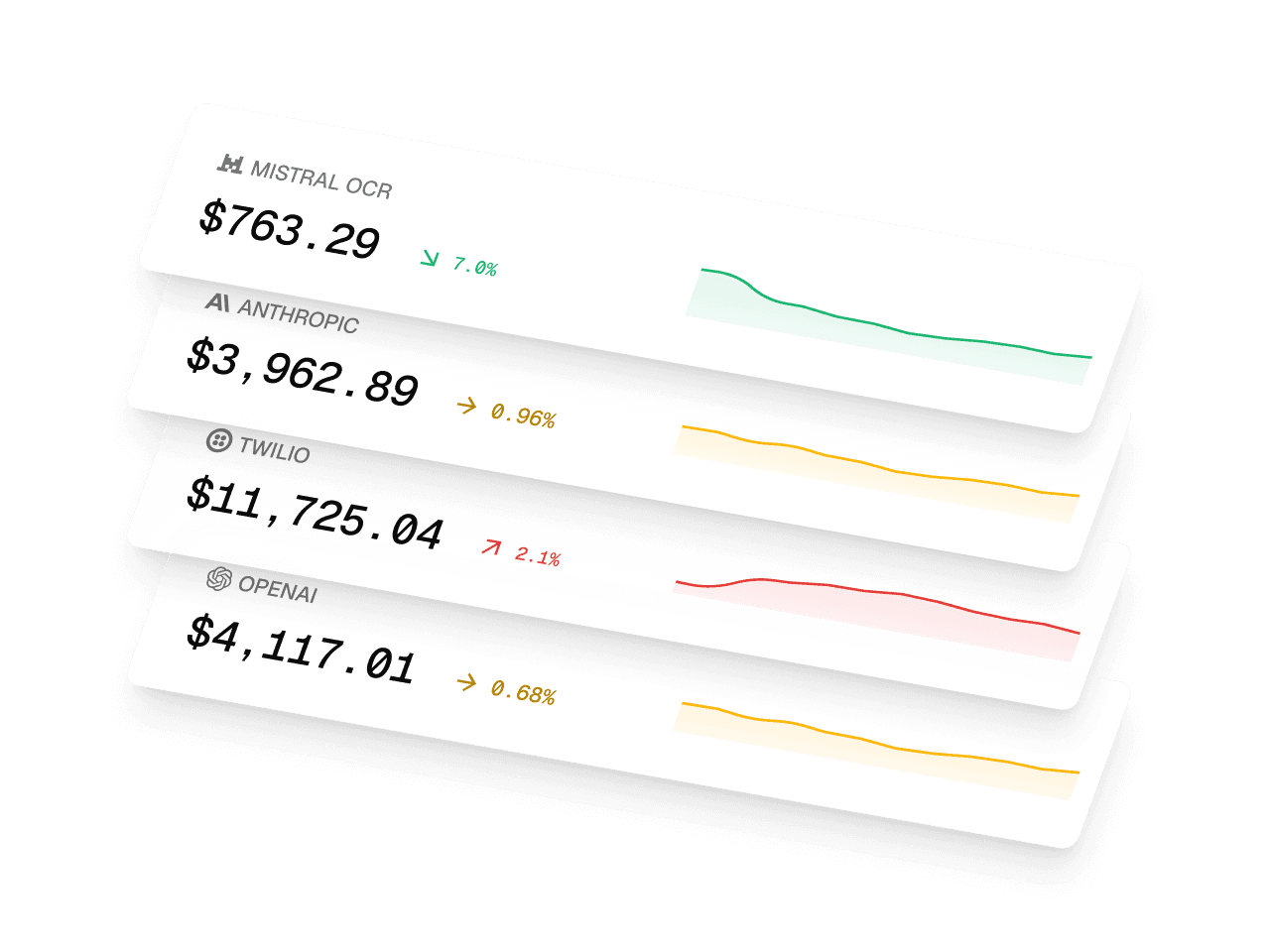

At Paid, we’ve built the world’s first growth engine for AI, helping companies navigate the transition from SaaS to AI agents.

Book a demo today to see how Paid can help you get back to growth.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes