Co-authored by Madhavan Ramanujam, Joshua Bloom & Dimi Hiotis

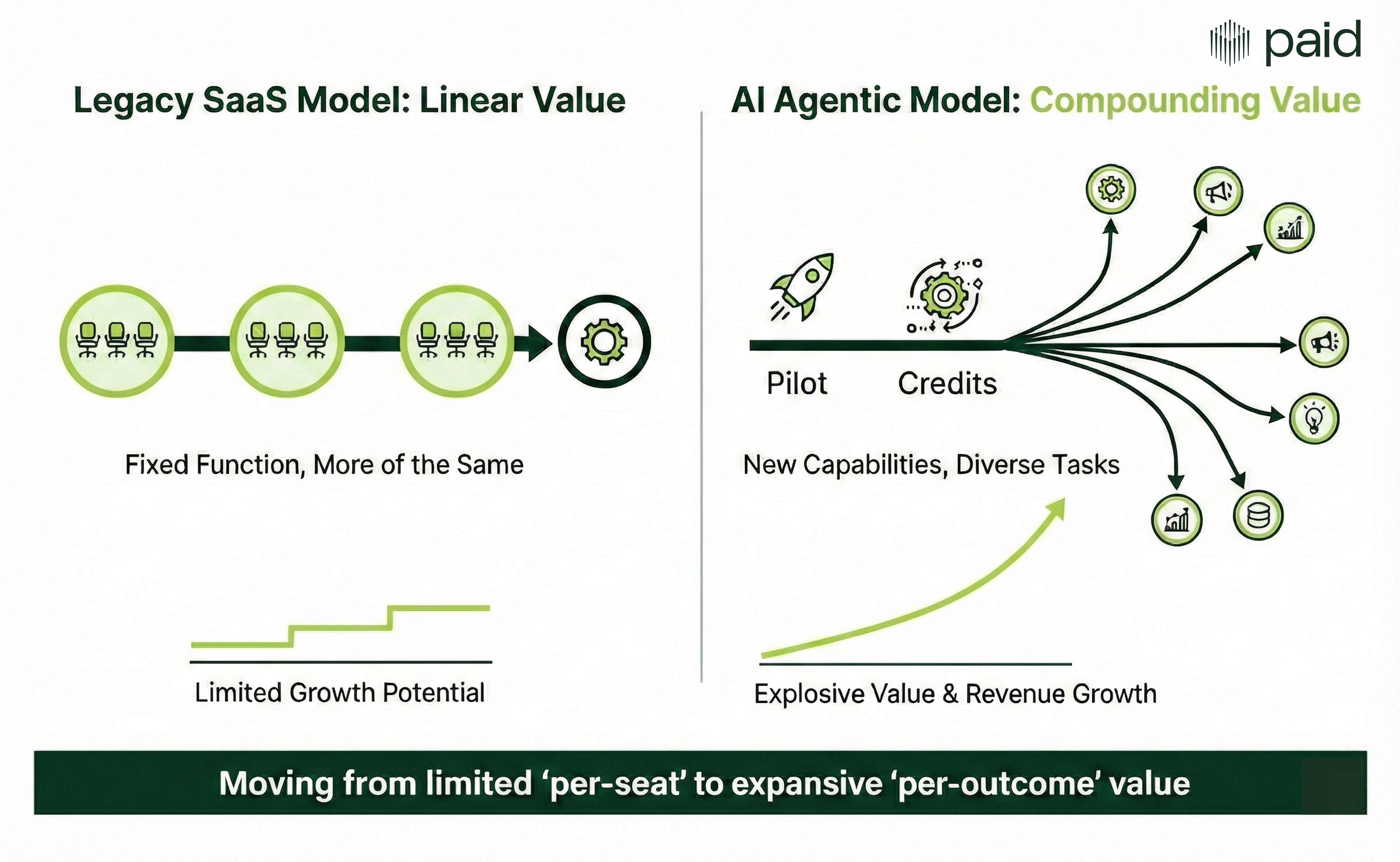

For two decades, the software industry has operated primarily under a single, dominant economic model: the seat-based subscription. This model was built for the SaaS era: a period defined by software as a tool designed to enhance human productivity. Legacy SaaS growth models like Product Led Growth (PLG) and Sales Led Growth (SLG) are inherently flawed for AI because they rely on human interaction - measured in seats - as a proxy for value. In the agentic era, software is no longer defined by worker access; it is increasingly a mechanism for autonomous productivity. When software stops assisting the worker and starts performing the work, the "seat" ceases to be an accurate proxy for value.

This article outlines the structural shift from selling software access to monetizing autonomous work. It applies a strategic 2×2 framework to help founders reason about AI pricing choices and describes two operational playbooks: Credit-Led Growth (CLG) for standardized scale and Impact-Led Growth (ILG) for bespoke value capture.

The Fundamental Shift: From Software as an engine to Software as a driver

The transition from traditional SaaS to AI-native applications represents a fundamental change in both the value proportion & cost of goods sold. In the legacy SaaS model, value was anchored in the user’s ability to take the wheel and drive the software to produce an output. It was also a world where the marginal cost to the vendor for supplying another seat was near zero.

In the Agentic AI paradigm, the software is an independent driver. Every "inference" or "agentic action" carries a real-time marginal cost in compute and tokens. Simultaneously, the value shifts from "enablement" to "completion". If an AI agent resolves a customer support ticket or refactors code, it is tapping into labor budgets rather than IT software budgets. Labor budgets are traditionally an order of magnitude larger, often 10x larger, because humans represented the predominant driver of real business outcomes.

Failing to recognize this shift leads to a structural misalignment. Founders applying traditional SaaS playbooks, PLG for bottom-up adoption and SLG for top-down selling, often find themselves trapped. They are forced to bundle expensive compute into flat-fee subscriptions, eroding margins while failing to capture the massive "alpha" created by their autonomous agents. To thrive, founders must move toward a value-based contract where the unit of monetization is the work itself.

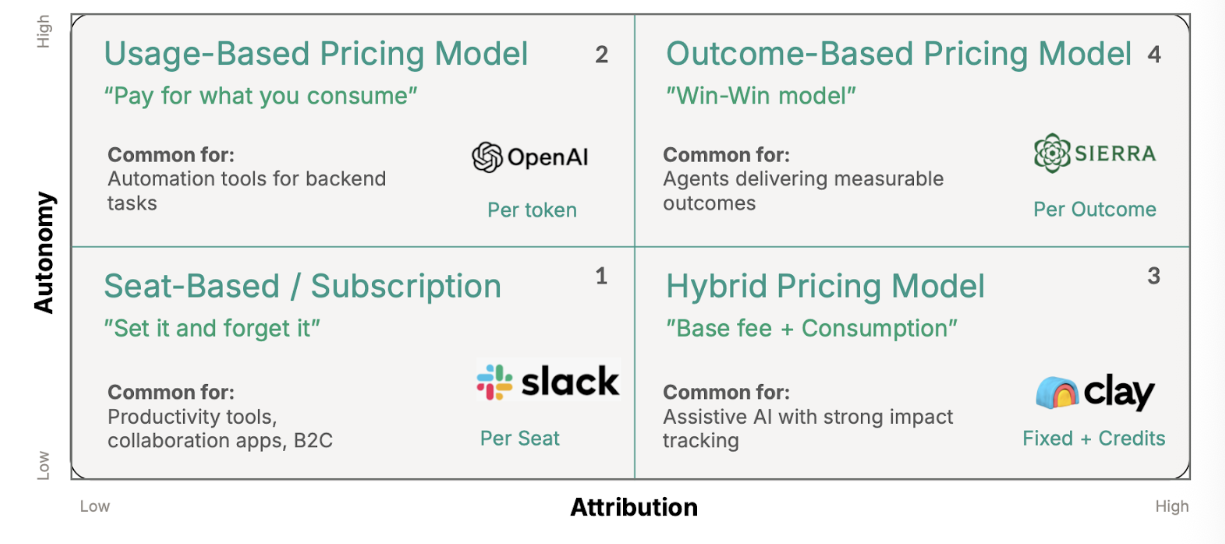

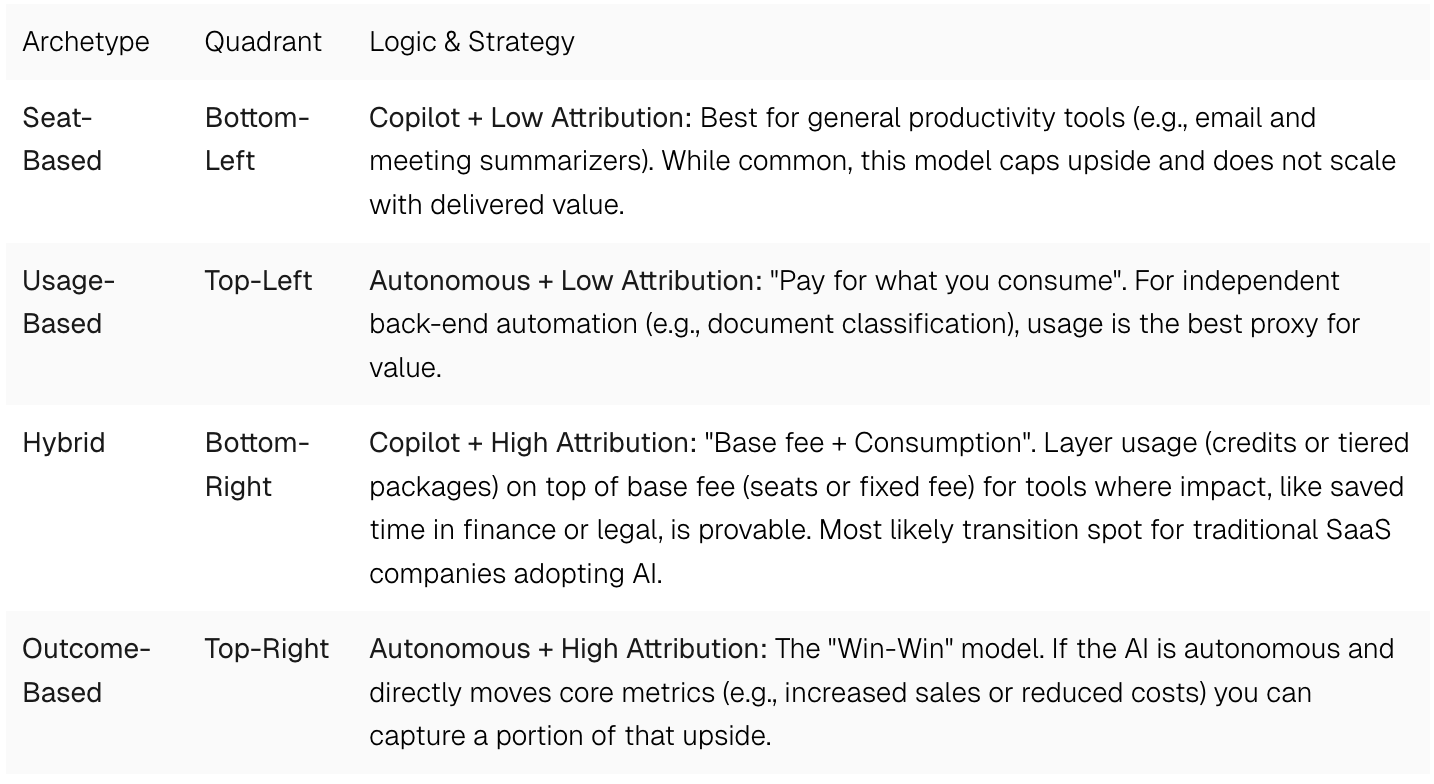

The Autonomy-Attribution Matrix: Choosing the right pricing model

Determining the appropriate pricing model requires evaluating a product across two dimensions:

- Autonomy: The degree to which the AI operates independently. Does it augment a human (Copilot) or act as an autonomous agent (Worker)?

- Attribution: The clarity with which the AI’s actions can be linked to a specific, measurable business outcome.

Mapping these axes yields four primary monetization archetypes:

Playbook 1: Credit-Led Growth (CLG) for a repeatable sales processes

For standardized deals spanning quadrants 2, 3, and 4, Credit-Led Growth (CLG) is the primary engine for scaling AI agent revenue.

The Concept: The vendor sells a standardized bucket of credits, with a simple credit schedule that assigns a fixed number of credits to every agent AI action or outcome, such as code check-ins, tickets resolved, or workflows completed. Each activity draws from the same credit pool, creating a universal mechanism for monetizing autonomous agents and delivering strong sales-market fit without introducing pricing complexity.

Strategic Value Proposition: CLG solves the "expansion friction" inherent in SaaS. In a seat-based model, monetizing a new use case requires a new procurement cycle. In a credit-led model, the user can draw from their existing package (of credits allocated) for any new AI capability the vendor ships, bypassing renegotiation. This creates a scalable, frictionless sales process where teams purchase buckets of credits and only discuss expansion (more credits) once credits are exhausted. Operationalizing CLG: Operationalization requires real-time telemetry of agent tasks to track consumption against provisioned credits. Crucially, the buy-side experience must prioritize transparency to avoid the bill shock often associated with usage-based models. Buyer-side dashboards are required to view produced value units (e.g., tokens consumed, number of accounts researched, resolutions made) and tools to manage, provision and forecast usage of credits. Paid.ai enables this by providing the necessary transparency, provisioning, and forecasting tools for buyers to feel in control. In addition Paid.ai offers the ability to set targeted promotional credits for new AI workflows to spur engagement and adoption.

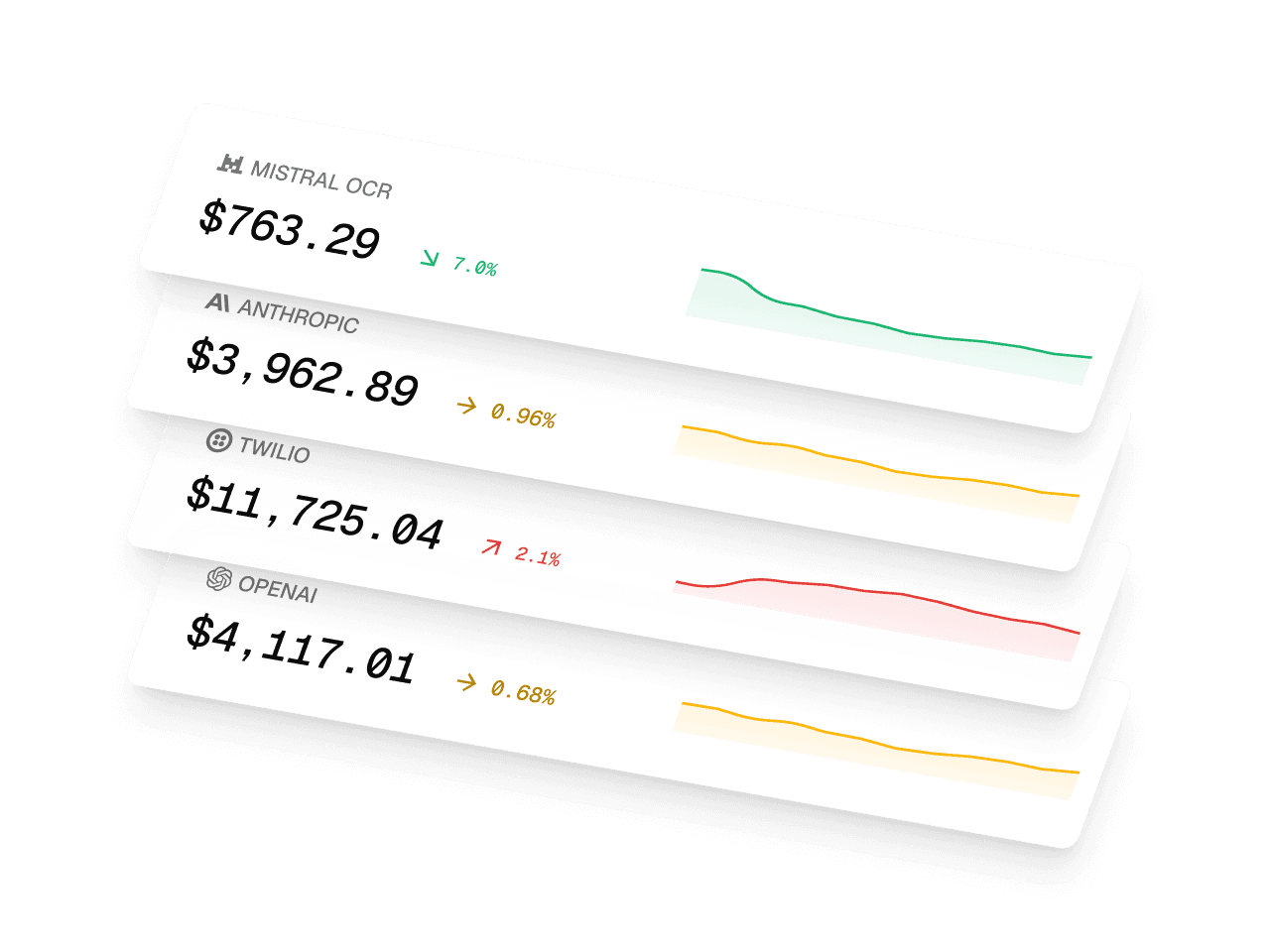

Operationalizing CLG: Operationalization requires real-time telemetry of agent tasks to track consumption against provisioned credits. Crucially, the buy-side experience must prioritize transparency to avoid the bill shock often associated with usage-based models. Buyer-side dashboards are required to view produced value units (e.g., tokens consumed, number of accounts researched, resolutions made) and tools to manage, provision and forecast usage of credits. Paid.ai enables this by providing the necessary transparency, provisioning, and forecasting tools for buyers to feel in control. In addition Paid.ai offers the ability to set targeted promotional credits for new AI workflows to spur engagement and adoption.

Case Study: The transition to agentic models is rarely just a technical evolution; it is a fundamental commercial overhaul. We see this paradigm shift most clearly in the transition of legacy sectors, such as the move from traditional DevOps tools to "AgentOps." For one such provider, this evolution required a total departure from seat-based subscriptions toward a model of credit-enabled charges for high-value outcomes. Working alongside this business, Paid.ai helped define the foundational steps for this transition:

- Outcome Calibration: A rigorous evaluation of the new agentic outputs to align them with a fair-market price based on the "work" completed.

- Commercial Re-architecting: Moving beyond simple subscription selling to design an entirely new sales motion where representatives are trained to sell a proposition of labor rather than a suite of features.

- Operational Implementation: Deploying a platform capable of handling the complexity of real-time outcome tracking and credit-based provisioning.

This case study illustrates that realizing the full economic potential of AI requires founders to master both the big-picture strategy of labor replacement and the granular, detail-focused implementation of a modern commercial stack.

Playbook 2: Impact-Led Growth (ILG) for bespoke negotiations

While CLG handles standardized transactions, Impact-Led Growth (ILG) is the playbook for high-stakes, bespoke enterprise deals where you can devote the time & energy to quantifying outcomes and capturing sizable value (quadrant 4).

The Concept: In an ILG model, the vendor moves beyond selling features to delivering verifiable economic results. The vendor co-creates a rigorous ROI model alongside the buyer, accounting for incremental revenue, hard cost savings, and reclaimed opportunity costs, thereby establishing a transparent baseline for success. The word co-create is key: when buyers actively participate in shaping the underlying assumptions (e.g., manual hours saved or conversion lift) for the business case, they become anchored in the logic and are far less likely to dispute the final outcome. This collaborative "value engineering" approach allows the vendor to move away from fixed pricing and instead negotiate a meaningful percentage of the total value created. Ultimately, this transforms the traditional transaction into a long-term strategic partnership, where the vendor’s upside is directly tethered to the actual value generated for the customer.

Strategic Value Proposition: Co-creation aligns incentives and unlocks budgets typically reserved for labor or outsourced services rather than traditional IT software. In this model, the vendor can capture a fair share of the value in key accounts, typically 25% to 50% of the total value created. By positioning the price as a fraction of the unlocked value, you recontextualize the cost from a line-item expense to a high-yield strategic investment.

Operationalizing ILG: To execute ILG, founders and "Value Engineers" must treat the Proof of Concept (POC) as a formal business case co-creation opportunity. The POC's primary goal should shift from mere technical validation to building a verifiable ROI case alongside the buyer. The POC should be structured as a "Commercial Experiment" governed by five tactical rules:

- Fixed-Fee Filtering: Charge a nominal, fixed fee for the POC. This is not for revenue, but to filter out "tire-kickers" and ensure the prospect has the internal authority to move the budget. It is imperative to be explicit that the POC price covers only the technical diligence and the co-creation of the business case and that commercial discussions will follow (after the value unlock is better understood by both parties). By clearly bounding the scope of the pilot in this way, it prevents the POC price from becoming a "low anchor" that could otherwise compromise leverage during the final commercial negotiations.

- Strict Time-Boxing: Limit the engagement, typically 30 to 90 days, with weekly milestones to prevent "pilot purgatory" and maintain momentum.

- The Three Pillars of Value: Quantify impact across Incremental Upside (new revenue), Hard Cost Savings (eliminated expenditures), and Opportunity Cost (reinvested human talent).

- Buying Center Access: Mandate involvement from the ultimate budget holder early in the trial. Ideally have weekly stakeholder meetings to socialize the business case: this eventually helps unlock budgets for the actual sale.

- Pre-defined "Success Logic": Secure a commitment upfront that if the success criteria are met, the buyer is prepared to present the business case to the executive committee for a full commercial rollout.

- Preparing for the actual negotiation: Successful ILG ends with a negotiation where the vendor must protect their price. Prepare a list of "gets" that the vendor can trade for any "gives" on price. If a buyer asks for a discount, the vendor should never simply cave; they should trade. A 10% price reduction might be granted only in exchange for a three-year term, or conducting a "value audit" every 6 months (which gives tremendous re-negotiation power during renewals). This ensures that even when the price is adjusted, the integrity of the negotiation and the strategic value of the deal remains intact.

Conclusion: Building the Commercial Architecture of the Future

We have moved beyond providing tools for the workforce, to providing a workforce that does the work. Monetizing work is not a mere pricing adjustment; it is a transformation of the organization's Commercial Architecture. It requires product engineering to incorporate telemetry, sales/RevOps to build ROI models, and value engineering teams to focus on driving measurable "outcomes." By leveraging the Autonomy-Attribution Matrix and the CLG and ILG playbooks, founders can ensure their businesses are aligned with the massive value generation of the agentic era.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes