SaaS companies face an uncomfortable reality. You've built a business on seat-based pricing, but AI agents are making that model obsolete. Your agents are starting to displace the seats you bill for, while your compute costs climb.

As revenue shrinks, and your margins compress, you're catching what the author of Monetizing Innovation and Scaling Innovation, Madhavan Ramanujam calls "a falling knife."

So how do SaaS companies respond to this reality?

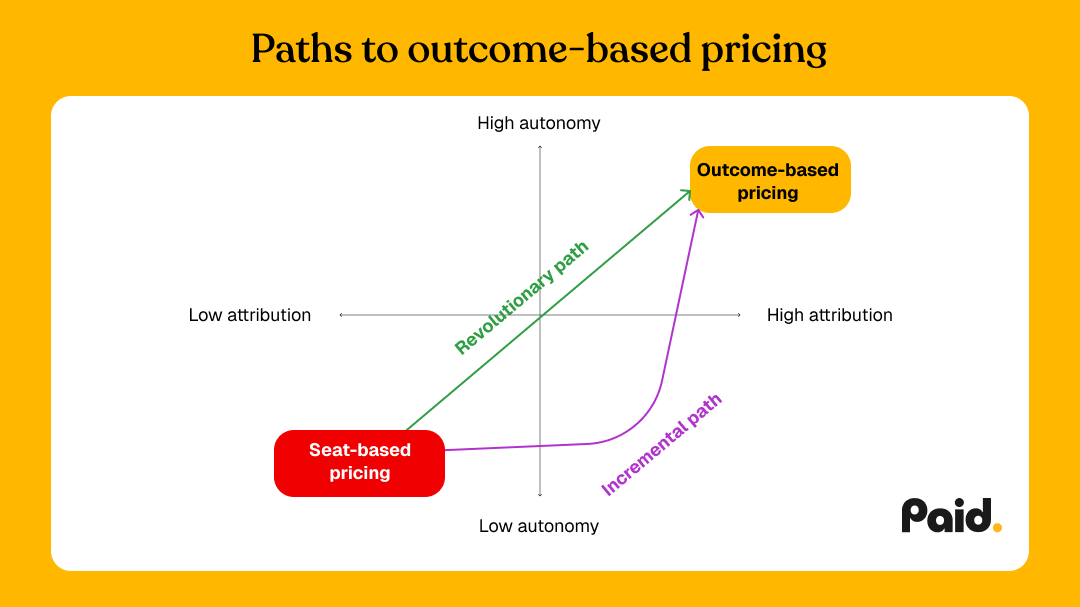

When we spoke with Madhavan on the Get Paid podcast, he described two distinct approaches: the incremental path where you move from seat-based pricing to a hybrid model, and the revolutionary path where you build net-new agent products with outcome-based pricing from day one.

Madhavan's latest book Scaling Innovation, co-authored with Eddie Hartman, provides a framework that clarifies which path fits your current situation. Built on two dimensions, the framework determines not just which pricing model works, but which transition path you should take.

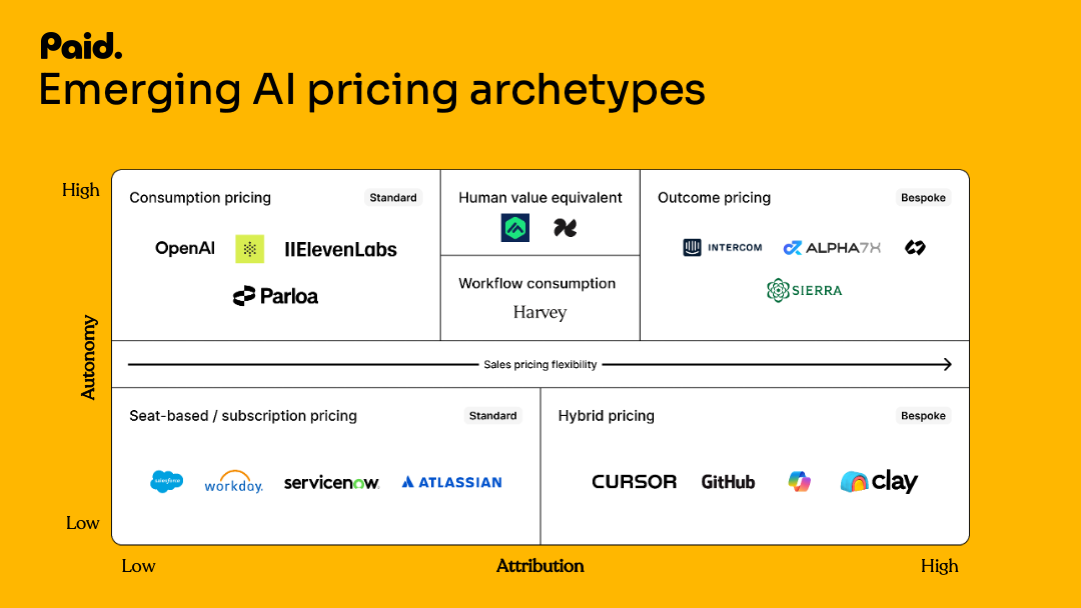

The attribution-autonomy framework

Madhavan's framework measures two things:

- Autonomy asks whether your agents can work independently or need humans in the loop.

- Attribution asks whether you can prove the agent created a specific outcome.

Plot these on a grid and you get four quadrants, each representing where companies sit today and where they need to move.

Most SaaS companies discover they're in the bottom left quadrant with low autonomy and low attribution. Your products assist humans but don't complete work independently, and you can't clearly prove their impact on business outcomes. This is where a product like Slack lives today. Everyone knows it boosts productivity, but you can't measure it or charge based on it. Workday, Figma, and Grammarly are here too. The value exists, but the attribution doesn't.

If you're deploying agents from this position, you're in trouble. Every agent you ship displaces seats you're billing for.

The incremental path: Move to a hybrid pricing model

The incremental path means moving from a seat-based model to a hybrid model, typically by offering your AI capabilities in bundles of credits on top of your monthly subscription.

This is what Clay did. Users pay a regular seat-based subscription with additional credits to spend on different data points and actions.

This hybrid model hedges both ways where seats maintain predictable revenue, while consumption creates expansion as agent usage grows.

Madhavan's advice for this path is to bundle a fixed monthly price with included usage. Convert your existing tiers to hybrid bundles where, for instance, Professional becomes $200 per seat with 3,000 tokens included, and Enterprise becomes $500 per seat with 10,000 tokens. When customers exceed their allocation, "you have an automatic conversation. You can just go to the next plan. You invented a land and expand model."

The key is defining what a token represents. Don't tie it to compute costs because those can vary 100x based on task complexity. Tie it to value delivered where one token equals one completed unit of work, like a ticket resolved or a meeting scheduled. This requires infrastructure that tracks outcomes and calculates what that work would have cost if done manually, not just API calls and compute time.

Most companies should take this incremental path because it requires less technical sophistication, less customer education, and less risk. You're meeting customers where they are with seat contracts, and layering on consumption models they've already seen with AWS or Snowflake. But understand what "incremental" actually requires: you need infrastructure that tracks outcomes, calculates value, and ensures expansion improves agent profitability instead of eroding it.

The revolutionary path: Build for outcomes from day one

The revolutionary path means jumping from the bottom left quadrant directly to the top right where you have both high autonomy and high attribution. You build a net-new agent product that works independently and prices on outcomes from the start.

This is what Intercom did with Fin. They didn't retrofit their existing support platform or add consumption charges to existing plans. They built Fin as a completely separate product with its own pricing model where users pay $0.99 per resolution.

ChargeFlow took the same approach by autonomously recovering disputed chargebacks and charging 25% of recovered revenue. The outcome is measurable, the attribution is clear, and the value split is explicit. No outcome means no charge. Perfect incentive alignment.

Madhavan notes that companies in this quadrant can capture 25-50% of the value they create, compared to 10% for traditional SaaS. The difference comes from increased autonomy and provable attribution. When you can demonstrate causation and quantify impact, customers will pay for results at rates that seem impossible under seat-based models.

To really enable this path Madhavan recommends treating early customer conversations as business case building exercises rather than tech validation. Co-create the case with customers to understand what metrics matter to them and how they measure success. This sets up natural outcome-based pricing conversations because you've quantified the value together.

Revolution, to be sure, comes with risks. This path works if your core business is stable enough to fund experimentation and you have technical sophistication to build closed-loop attribution. You need to identify workflows where you can achieve both high autonomy and high attribution. Support ticket resolution is the canonical example with its clear start point, clear end point, and measurable outcome. But look for others like sales qualification, data processing, or compliance checking.

Choosing the right pricing model for you

Where are you today on autonomy and attribution? Which dimension can you improve faster? That determines your path.

If you can build better measurement systems to prove agent value but can't yet build fully autonomous agents, take the incremental path. Move to hybrid pricing where you keep agents in the copilot role but introduce consumption charges based on demonstrated value. This is the safer path that most companies should follow.

If you can build both high autonomy and closed-loop attribution, consider the revolutionary path. Build a net-new agent product that works independently and prices on outcomes from day one. Run it as a separate initiative with its own economics, like Intercom did with Fin. This path captures more value but requires more sophistication.

Some companies will do both. Hybrid pricing for the core product protects existing revenue while you build outcome-based pricing for new agent products to capture the future. The hybrid model funds the transition while the outcome model proves the economics work.

But staying in the bottom left quadrant isn't an option. You need to transition to agent pricing, and these are the two paths that work.

The companies that choose a path deliberately and build the infrastructure to support it will thrive. The ones that wait will watch their competitive position erode. Until one day the transition becomes a crisis instead of a choice.

Are you exploring pricing models for your AI offering? Book a Paid demo today and see how the world’s only growth engine for AI can help you.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

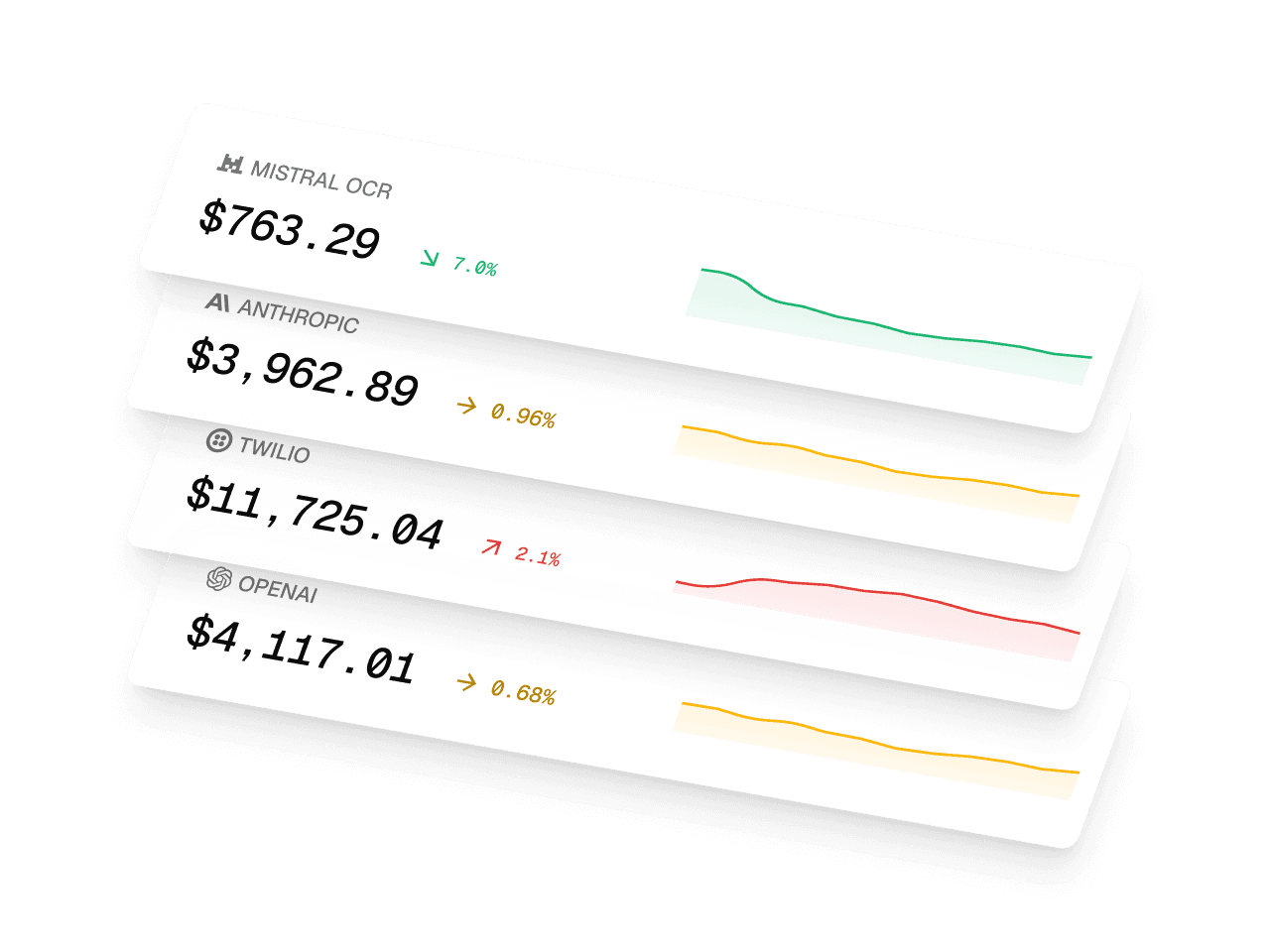

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes