If you're a SaaS company transitioning to AI agents, you've likely noticed something alarming. Your unit economics don't make sense anymore.

The traditional metrics that guided software companies for decades are breaking down, creating a profitability crisis across the AI industry.

Here's what's happening and how the winning SaaS companies are adapting their business models to survive the shift.

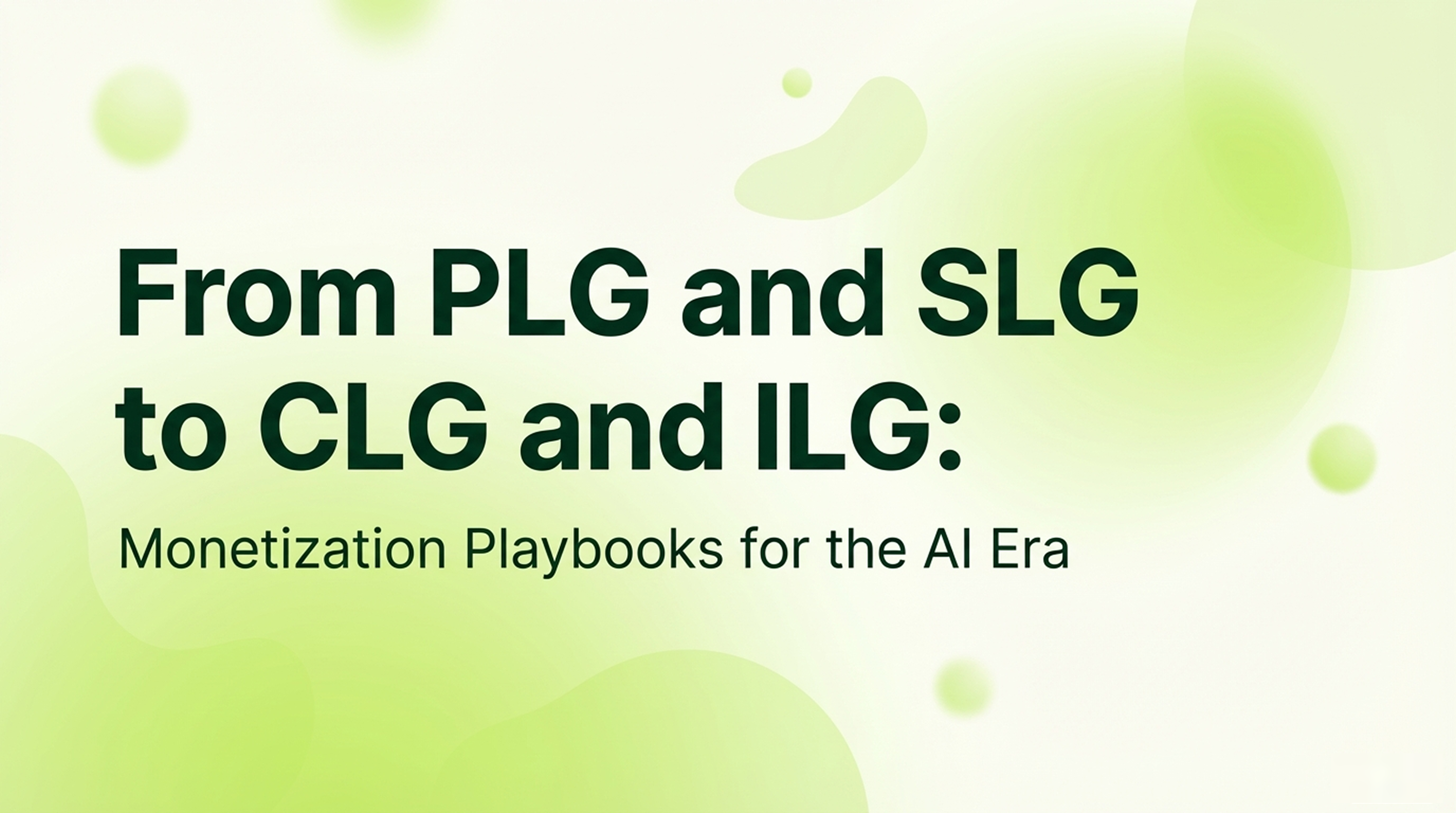

The rule of 40

For those unfamiliar, the Rule of 40 has been the gold standard for measuring SaaS company health. The formula is simple: growth rate + profit margin = rule of 40 score.

A healthy company will score 40+.

A score of under 40 indicates that your company is not balancing growth and profitability effectively.

A healthy SaaS company typically operates with:

- 20% net profit margin

- 20% year-over-year growth

- Rule of 40 score: 40% (meeting the benchmark)

This worked because traditional SaaS had predictable cost structures that looked something like this:

- 20% Cost of Goods Sold (COGS)

- 25% sales & marketing

- 25% research & development

- 10% general & administrative

- 20% net profit

With 20% profit, 20% growth was sufficient to keep your company in the black.

AI agent economics are different

The rule of 40 looks very different for AI-native companies, or SaaS companies with strong AI offerings.

The biggest difference is COGS. You still have all your original costs, but now you have a ton of AI costs associated with LLM and tool calls. Instead of 20%, COGS is more like 40%,

But none of your other costs go down.

That’s probably why Bessemer’s State of AI 2025 report found that negative margins are not unusual for the fastest growing AI companies.

Let’s look at what happens to your profit when COGS goes up.

- 40% COGS

- 25% sales & marketing

- 25% research & development

- 10% general & administrative

- -20% net profit

With -20% profit margins, AI agent companies need to grow at 60% year-over-year just to meet the rule of 40 threshold.

The hottest AI companies are hitting these growth rates. But this pace isn’t sustainable long-term.

Something has to give.

Where are you going to cut?

Okay, so it’s not looking good. But surely you can make some cuts and get those margins back to a healthy level?

This is a reasonable reaction, but to make the numbers make sense, these cuts are going to have to come in the form of layoffs. And layoffs are going to impact growth.

If you cut your R&D costs, you’ll be losing the engineering talent that gives your product its competitive edge. In fact, as you build more agentic capabilities into your products, you’re going to need to spend more on great AI and ML talent, not less.

Maybe you can tighten up G&A, but making significant cuts to your perks, rent, administrative staff, travel costs and/or software licenses is going to drive your top talent into the hands of your competitors.

It’s tempting to think you can cut back on sales and marketing. Recouping those 12% commissions you’re paying out to salespeople would go some way towards restoring your margins.

But during this shift from traditional SaaS to agentic AI, sales and marketing is more important than ever. You’ll need to make significant investments in marketing to retrain your ICP on your new way of thinking. Salespeople will need to be strategic advisors, hand holding customers through the most disruptive software shift since SaaS.

There might be some wiggle room here. And it might look a bit different to what you’re used to…

Aligning sales compensation with margins

Hear me out.

What if more companies started moving sales commissions from percentage of revenue to percentage of margins?

It’s not that far out. Door-to-door salespeople selling encyclopedias and cookware were selling this way long before SaaS existed. If they offered a discount, it came out of their own pockets.

Margin-based compensation aligns sellers with the same metrics that matter to your business: more deals, bigger deals, and bigger margins.

When sellers are compensated on margins, they're incentivized to:

- Negotiate pricing that reflects value

- Upsell higher-margin features and capabilities

- Qualify prospects who will be profitable customers

- Minimize discounting that erodes already-thin margins

The broader implications for AI SaaS

This idea of shifting to margin-based compensation is just one way companies might rethink their business models in the journey from traditional SaaS to agentic AI.

Other moves will include:

- A shift toward outcome-based pricing: Quantifying the value a product delivers will enable companies to increase ACVs while remaining highly competitive.

- New product lines: More companies will break out AI functionality into entirely new product lines where they can retrain customers on how to think about value.

- More quantifiable proofs of value: The proof of concept is here to stay, but companies will need to quantifiably demonstrate value to turn POCs into ARR.

The companies that adapt quickly will have a significant competitive advantage. Those that try to operate AI agent businesses with traditional SaaS assumptions will struggle to achieve sustainable profitability.

Get back to growth

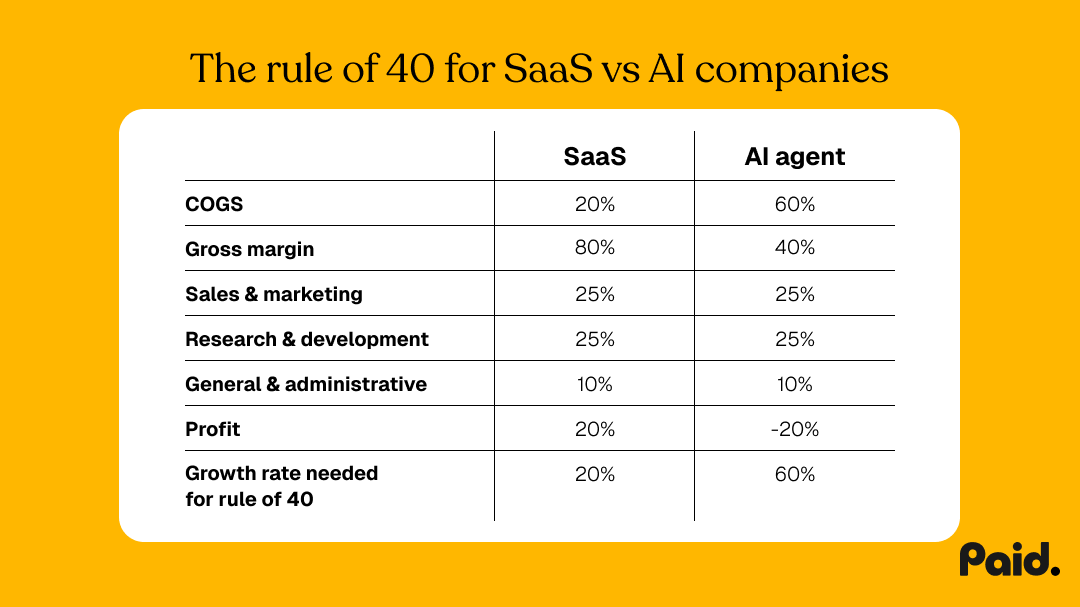

At Paid, we’ve built the world’s first growth engine for AI, helping companies navigate the transition from SaaS to AI agents.

Book a demo today to see how Paid can help you get back to growth.

Stay ahead of AI pricing trends

Get weekly insights on AI monetization, cost optimization, and billing strategies.

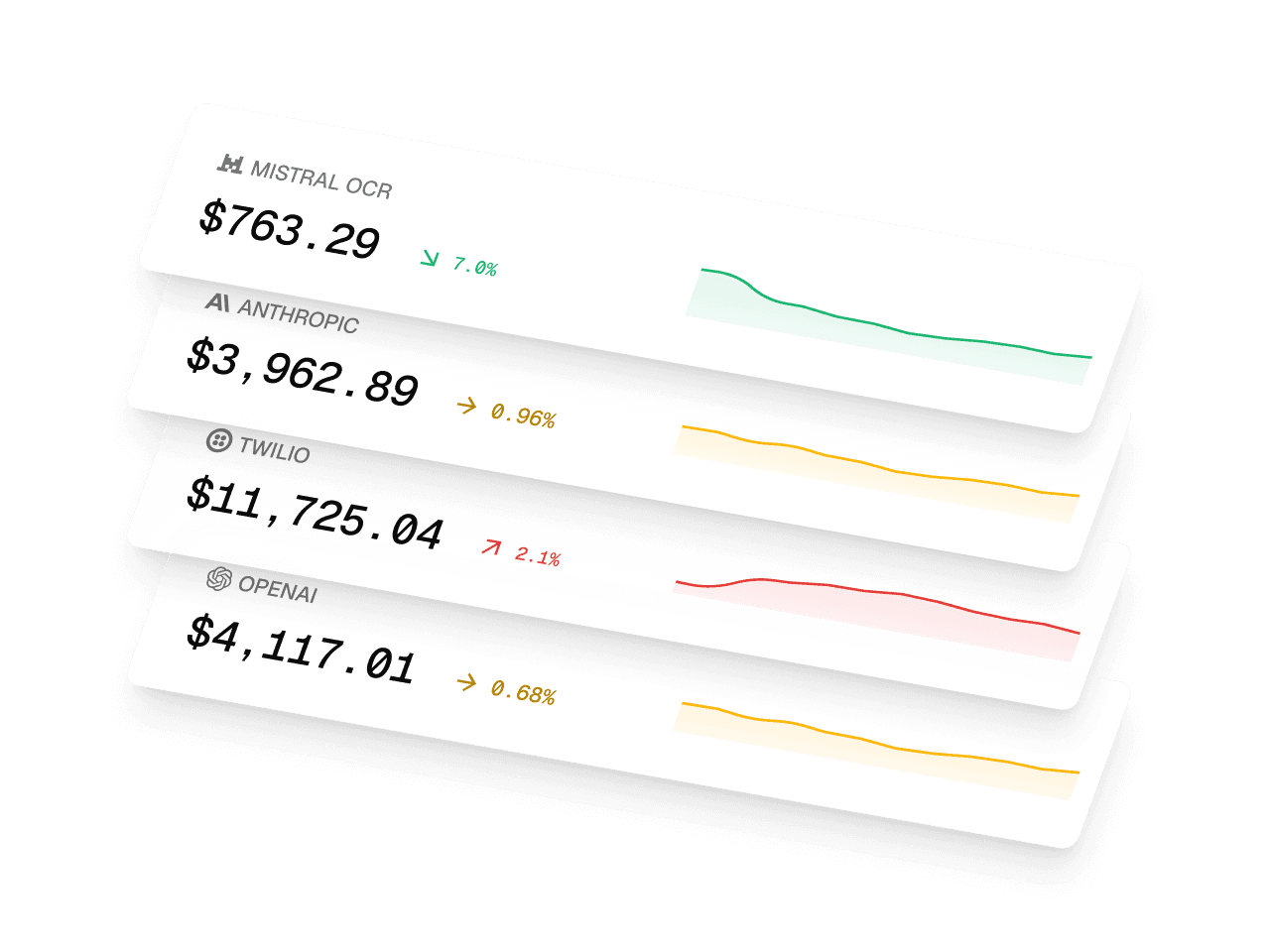

Monetize AI Without the Headache

The billing platform built for AI companies. Launch pricing models, track costs, and optimize margins—no engineering lift.

- Track AI costs by model & customer

- Launch usage-based pricing fast

- Know your margin on every deal

- Integrate in minutes