Insights straight to your inbox

Join 10,000+ subscribers getting the latest insights on AI monetization.

Everyone (mostly us) keeps saying seat pricing is dead, and some people are arguing with us online.

I think that's cool, but it's because they don’t understand why it’s dying.

For twenty years, SaaS revenue scaled with headcount.

More humans = more seats.

That logic held so long that we stopped questioning it.

Then the humans disappeared.

So seat pricing didn’t just die, its margins migrated. The value once captured in human licenses now lives in compute bills.

But let's understand why:

Seat-based pricing made perfect sense in the era when software automated people. A CRM helped a sales rep. A design tool helped a designer. A support platform helped an agent.

You could literally count your customers by the number of logins.

Here, I'll put it in a table:

Era | Unit of work | Unit of value | Pricing proxy |

|---|---|---|---|

SaaS 2005–2020 | Human performs workflow | Productivity per human | Per-seat license |

That means growth looked like this:

more employees → more seats → more ARR.

I definitely experienced this first-hand at the SaaS companies I worked at, and it was beautifully linear and predictable.

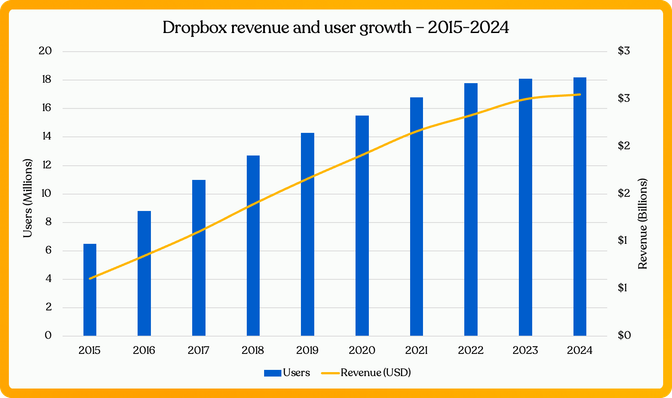

Dropbox's public data shows it pretty well too.

And for a long time, that linearity made everyone lazy.

Seat pricing broke quietly, and then all at once.

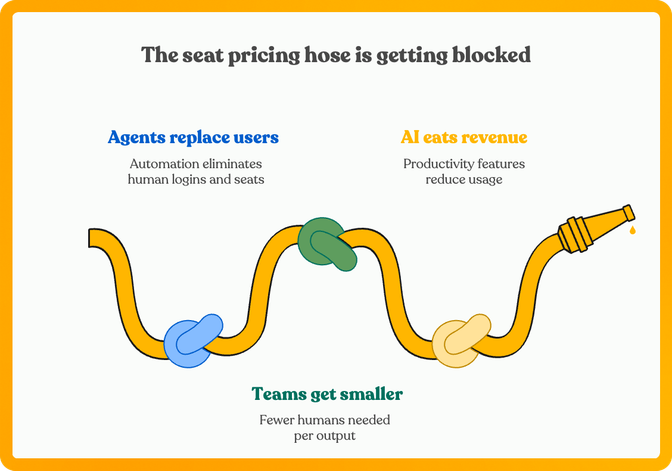

Three structural shifts made it inevitable:

Shift | What changed | Why seats fail |

|---|---|---|

Agents replace users | Work is done through APIs and automation | Agents don’t log in and don't use a seat |

Teams get smaller | Ten people with agents can do the work of a hundred | Headcount stops scaling with output, and not everyone needs these tools |

AI features eat their own revenue | Every “productivity” feature removes usage minutes | Seat expansion becomes self-defeating |

Seat pricing depends on more humans doing more work. AI depends on fewer humans doing less work.

That’s not a market correction. It’s a phase change.

Hybrid pricing (seats + usage + minimums) is a holding pattern. Companies add "usage components" not because it’s the future, but because it helps them stay afloat while their core metric stops working.

Hybrid pricing is what disruption looks like from the inside - and you can see it in product telemetry across the industry:

Seat pricing worked so well it trained an entire generation of SaaS companies to chase adoption metrics that don’t matter anymore.

User logins.

Seats activated.

Seat expansion revenue.

Those signals once indicated health.

Now they measure inertia.

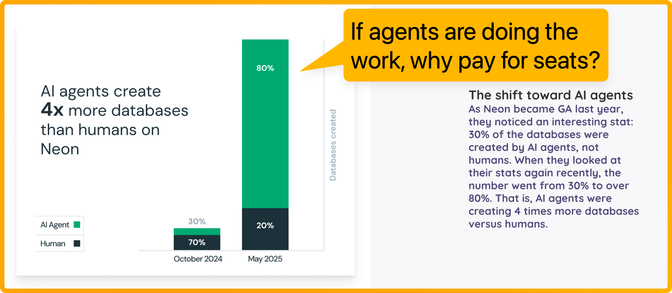

When customers replace 50 support agents with one orchestrator running 50 AI assistants, seat metrics collapse — even though the system’s output increases 10×.

The problem isn’t that usage-based pricing is new.

The problem is that SaaS never had to think about what it’s actually selling.

The next pricing substrate is not per-seat, but per-work.

We’re already seeing three archetypes emerge:

Model | Example | Unit of value |

|---|---|---|

Usage-based | API calls, tokens, compute minutes | Workload volume |

Outcome-based | Leads verified, tickets resolved | Business result |

Agent-based | Cost per autonomous agent / month | Synthetic labor |

The line running through it all is clear (at least to some of our partners): value tracks work done, not humans doing it.

Unfortunately, this will feel messy for a few years

Just like AWS billing did in 2008: complex, unpredictable, but a lot more aligned with the actual source of value.

The SaaS economy grew up during an era of abundance with cheap capital, expanding headcount, endless GTM motion.

Seat pricing thrived because companies were hiring faster than they were automating, but 2021-2022 is over.

AI agents don’t take vacations, and they don’t show up in HRIS exports (not yet, anyway).

They don’t need training seats, onboarding credits, or license renewals.

They just execute.

Seat pricing is a tax on humans. And in the next decade, humans stop being the primary unit of work.

We’re heading toward agentic billing models that look a lot like infrastructure pricing:

Yes, it'll start rather messy with the tokens/credits, hybrid models and caps - but this will converge toward work-per-unit-time and eventually outcomes.

When that happens, pricing becomes both simpler and truer:

Software bills for what it delivers, not who touches it or how much inputs it used.

Every few decades, software changes its unit of measurement.

Era | Unit of measure |

|---|---|

Desktop | License |

Cloud | Seat |

AI / Agentic | Work (and later value) |

The tl;dr is seat pricing isn’t dying from lack of innovation - it’s dying from irrelevance.

You can fight it, but when the average company has more agents than employees,

the only question left is simple:

What’s your new denominator for software value?

Join 10,000+ subscribers getting the latest insights on AI monetization.

Price smarter. Protect margins. Grow revenue.