Build agents, get paid

Understand your margins and get paid for the value your agents create.

This report is based on analysis of 250+ conversations with SaaS companies and agent builders navigating the AI transition

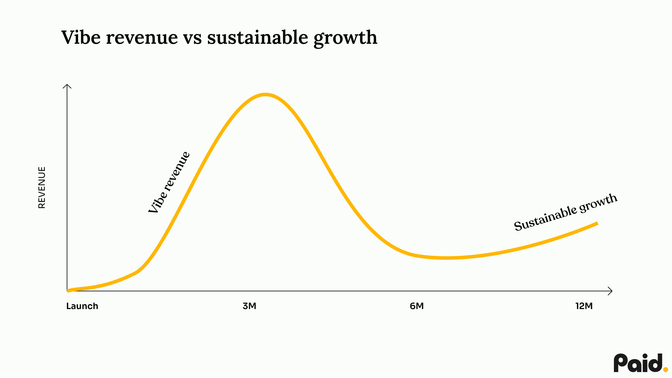

SaaS companies adding agent features face a critical monetization challenge. After analyzing 250+ conversations with companies ranging from early-stage startups to enterprises, a clear pattern emerges: 75% of companies building agents have no systematic approach to pricing them.

This creates what we call "vibe revenue". Strong initial adoption followed by 70% churn rates.

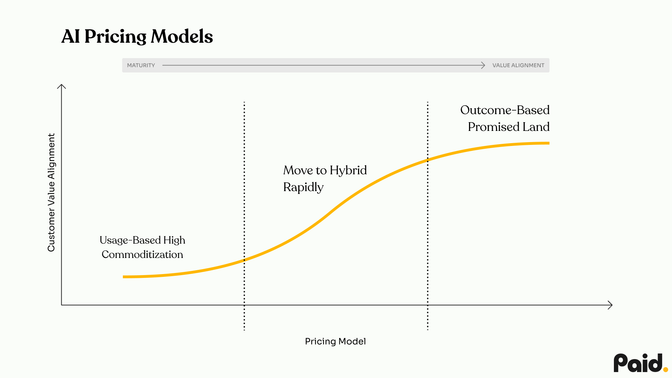

There is a small subset of companies are thriving, who have moved beyond usage-based pricing to value-aligned models that defend against commoditization and build sustainable revenue streams.

This report outlines their playbook.

State of the market

Distribution of pricing models

Success indicators Companies with outcome-based elements achieve:

Representative quotes from our interviews:

"We are closing our first enterprise client but we just kind of made a ballpark estimate on price." — Sustainability compliance platform

"To be perfectly honest, pricing is a mess. It's all over the place." — AI SDR platform

"We entered the market at $1,500 as a base price. We were having lots of positive conversations until we got to price. So we went to $750 and were still getting eyebrows raised. So we went down to $500." — AI SDR platform

This informal, intuition-driven approach creates three problems:

When supply explodes, vibe pricing accelerates race-to-bottom dynamics:

This means that your initial explosive ARR has now stalled.

Traditional SaaS had predictable costs, but agent features introduce radical variability.

Scenario | Cost per Interaction |

|---|---|

Simple task | $0.02 |

Complex reasoning | $2.00 |

Variance | 100x |

One company discovered their AI SDR sent emails at negative 22% margin. Every email lost money.

"One of the biggest challenges I'm seeing is not only figuring out how to monetize properly, but also how to manage the resources they're using." — Small business operations platform

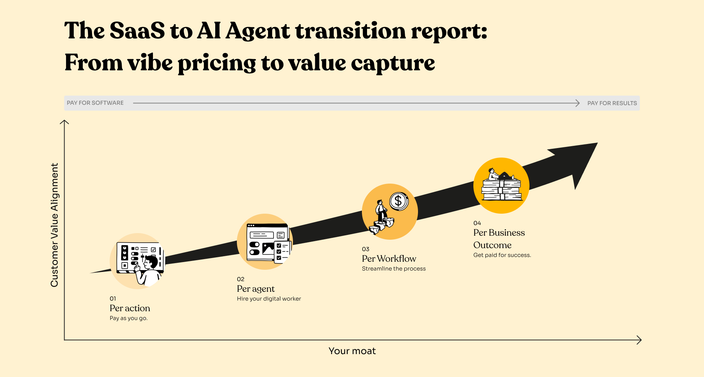

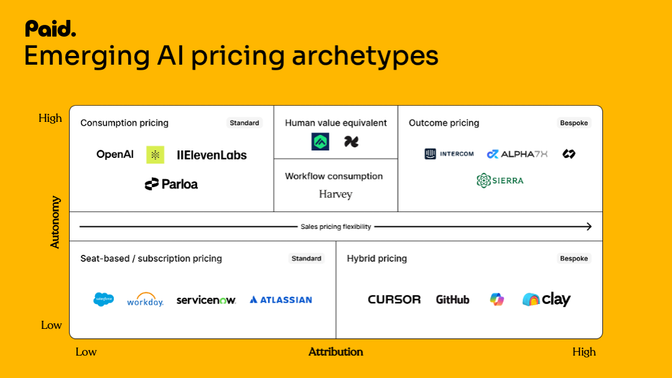

Based on our analysis, the market has converged on four approaches:

Model | Market Share | Defensibility | Margin Profile | Churn Risk |

|---|---|---|---|---|

Usage-based | 45% | Low | Variable | High |

Per-agent | 20% | Medium | Medium | Medium |

Workflow-based | 15% | Medium-High | Good | Low-Medium |

Outcome-based | 20% | High | Excellent | Low |

Structure: $0.10 per email, $0.20 per call, $0.05 per data point

Advantages:

Vulnerabilities:

Structure: $2,000/month for an AI SDR vs. $5,000 for human equivalent

Advantages:

Vulnerabilities:

Structure: $10 for completed multi-step process (research, qualify, compose, send, follow-up)

Advantages:

Considerations:

Structure: $200 per qualified meeting, $0.99 per ticket resolved, $500 per contract processed

Advantages:

Challenges:

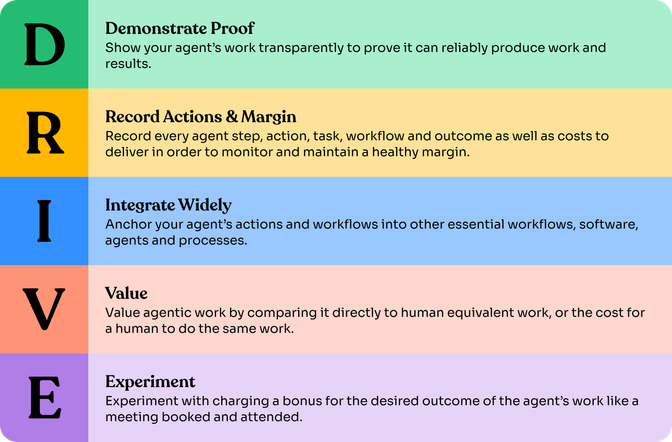

Successful companies don't jump to outcomes.

Start with low-risk, high-visibility tasks:

"We started with simple lead enrichment before moving to full sales automation." — CRM platform that grew to 2,000 seats in 90 days

Track obsessively:

"Our AI SDR had negative 22% margin per email until we implemented proper tracking. Now we maintain 67% margins through dynamic optimization."

Create stickiness through:

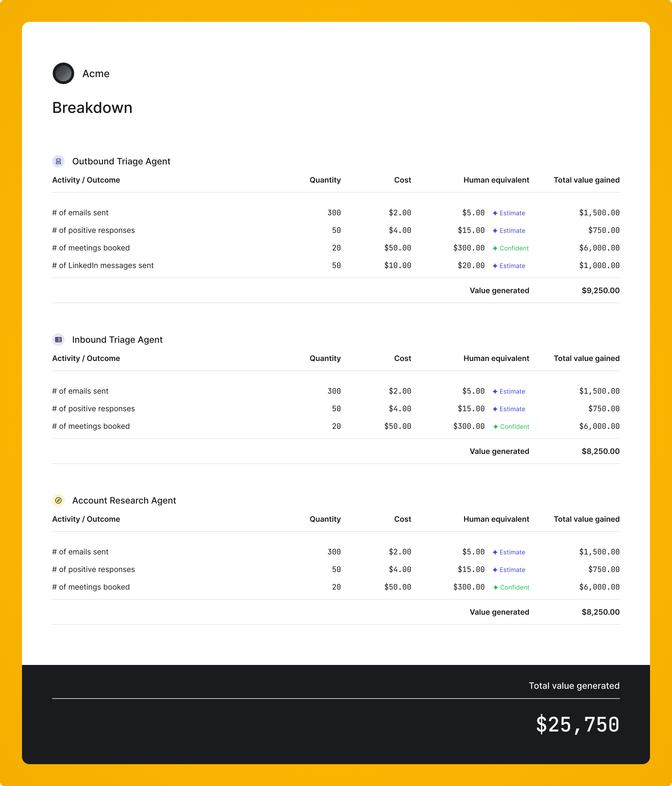

Every invoice should communicate something like this:

This anchors discussions to $60,000 salaries, not $49 software subscriptions.

"Showing the work gets people really excited because they feel like they're getting more than what they actually pay for." — CEO of a Cybersecurity platform

Paid's value receipts are a great example of this.

You should move towards outcomes as much as possible. Your evolution timeline:

"The pricing we launch is going to be something basic just credits because we need to get this thing out and test it. In later workstreams we'll evaluate pricing in a more nuanced way." — Founder of a Sales enablement platform

Current State:

Winner Profile: Companies charging per qualified meeting or per opportunity created. One AI SDR company charges $200 per attended meeting with 94% gross margins.

Current State: Moving fastest to outcomes

Examples:

Winner Profile: Resolution-based pricing with quality guarantees

Current State: Most stuck in seat-based models, some moving to usage-based "copilot" pricing

Vulnerability: Highly susceptible to disruption due to low switching costs

Winner Profile (Emerging): Companies charging per successful deployment or per bug fixed. Still rare.

Winners across verticals share three characteristics:

Moving to outcome-based pricing introduces four common objections:

"The AI didn't cause that meeting."

Paid recommends: Define attribution windows and methodology upfront. Last-touch, 30-day windows work for most B2B scenarios.

"That wasn't a qualified lead."

Paid recommends: Establish mutual quality criteria before deployment. Document in contract.

"An SDR meeting isn't worth the same as a C-suite meeting."

Paid recommends: Create tiered outcome pricing based on lead quality or seniority.

"Too much responsibility shifted to vendor."

Paid recommends: Hybrid models that balance risk.

One AI SDR company's working model that we helped them develop included:

"We moved back from pure outcomes to hybrid. It balances risk while maintaining alignment."

Instead of pure variable pricing:

This gives enterprise customers predictability while maintaining value alignment.

These are specifically for SaaS companies adding agentic features

Immediate actions (Month 1 - do this now):

Short-term evolution (Months 2-3):

Medium-term transition (Months 4-6):

Long-term position (Months 6+):

The underlying AI models will commoditize. OpenAI, Anthropic, and others will drive costs down 90% or more, but new models will come by - your differentiation cannot come from the models themselves.

The SaaS companies that capture value will be those that master the journey from usage to outcomes faster than competitors.

The path is clear:

We believe this transition is inevitable - but you control the pace in which you adopt it.

This report synthesizes findings from 250+ conversations with SaaS companies and agent builders conducted between January and October 2025. Participants ranged from early-stage startups to public companies with 60,000+ employees, across verticals including RevTech, customer service, developer tools, compliance, and business operations.

Paid helps SaaS companies understand agent economics, track value delivery, and implement outcome-aligned monetization models.

Understand your margins and get paid for the value your agents create.

Price smarter. Protect margins. Grow revenue.